Global Trustee and Fiduciary Services News and Views

| Issue 47 | 2017

11

• Mandates managed by a QFII, QFIIs’

proprietary money if the QFII does not qualify

as a Long-Term Fund, funds managed by a

QFII that do not qualify as Open-end China

Funds, etc. (Other Funds).

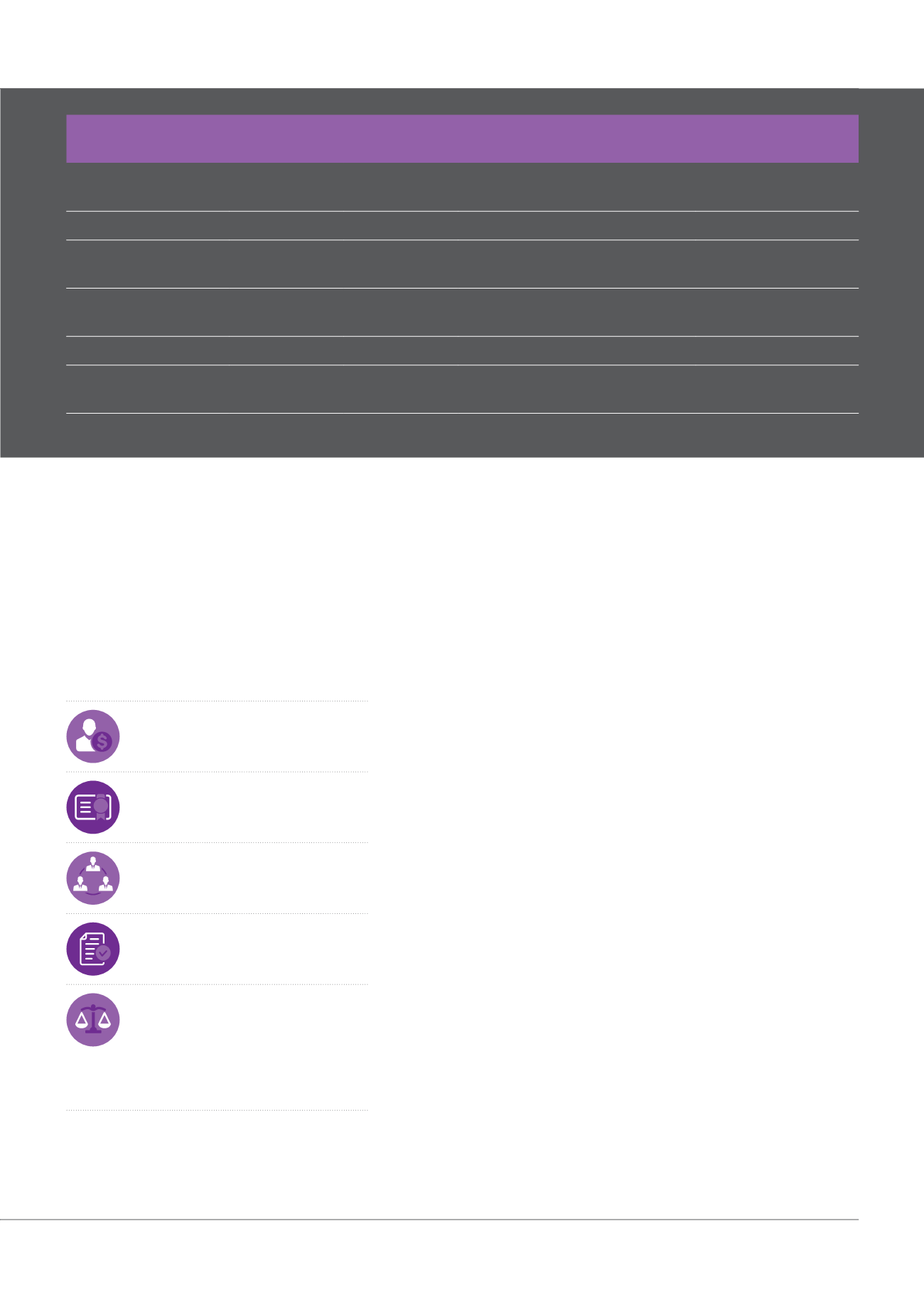

Process and accessing the QFII regime

To qualify as a QFII, applicants must meet the

threshold conditions and tests summarised

below (see too table above):

Applicants must satisfy various

financial thresholds (table).

The investment team of the QFII must

meet the necessary professional

standards prevalent in its home country.

The QFII must have appropriate

internal systems, controls and

corporate governance.

The QFII must have at least three

years’ clear regulatory record with

no material penalties imposed.

The QFII must be established in a

jurisdiction with a well established

legal and regulatory regime that

has entered into a memorandum of

understanding with the CSRC and has

a good relationship with the CSRC.

In general, it would be expected that most

large retail asset managers and pension

funds in the UK should be capable of meeting

these conditions.

Investment restrictions and requirements

As with most methods of accessing the

Chinese markets, the QFII regime includes

several restrictions on investing in the market

and repatriation of capital.

Investment quotas

Previously, QFIIs were required to obtain prior

approval from SAFE for each investment quota.

The 2016 rule changes have now relaxed this

requirement. Participants have only a simple filing

obligation with SAFE if the investment quota is

within a certain percentage of the asset value

or AUM of the QFII — what is known as the “base

investment quota”. It should be noted that the

base investment quota will not apply to certain

QFIIs such as sovereign wealth funds, central

banks, long-term investors or monetary authorities.

Participants wishing to increase their quota —

within the parameters of the base investment quota

— may also do this by way of filing. Increases that

will take a QFII outside the base investment quota

still require prior SAFE approval.

Mandatory investment

Previously, under SAFE regulations, QFIIs

were required to invest the full amount of the

investment quota granted to them within six

months of receiving SAFE approval. This has been

relaxed somewhat, and QFIIs have up to a year to

invest their quota, any balance remaining being

liable to be revoked by the SAFE at its discretion.

Lock-in periods

All QFIIs are now subject to a mandatory three-

month lock-in period, during which no invested

funds may be withdrawn. The lock-in period now

Applicant

Operating

history

Net assets

Assets held or managed

(during preceding accounting year)

Other requirements

Asset management

institutions

2+ years

N/A

At least USD500 million

N/A

Insurance companies 2+ years

N/A

At least USD500 million

N/A

Securities companies 5+ years

At least

USD500 million

At least USD5 billion

N/A

Commercial banks

10+ years

N/A

At least USD5 billion

Tier-one capital of at

least USD300 million

Trust companies

2+ years

N/A

At least USD500 million

N/A

Other institutional

investors

2+ years

N/A

At least USD500 million

N/A