7

Citi Perspectives

| Q1/Q2 2015

teams with more control over

the levers to change Days Sales

Outstanding and Days Payables

Outstanding, improving cash

conversion cycles. When payment

terms are extended, supply chain

financing provides support to

vendors, who may be smaller and

more credit-challenged than their

multinational corporate buyers. It

is clear that more companies are

deploying these approaches:

In Citi’s Treasury Diagnostics

benchmarking survey, 34% of large

corporates surveyed are using supplier

financing solutions today, compared

with only 21% five years ago.

2

By taking these actions, treasurers

can free cash trapped in the

balance sheet and deliver tangible

shareholder value.

Integrating regulatory changes

into treasury structures

Country capital controls drive

whether and how local markets’

cash and funding activity can be

integrated into the company’s global

treasury structure. China especially

stands out with regard to opportunity.

Despite the recent slowdown, it will

continue to be a major growth market

for many multinationals. Meanwhile,

regulatory reforms and the

internationalization of the renminbi

have fundamentally altered what

companies can achieve in treasury

management. Multinationals can

now centralize nationwide payments

and collections processes in China,

concentrate domestic cash and link

this to their global liquidity pools, and

use netting and reinvoicing structures

to centralize FX risk management

into their global in-house banks.

2

Citi Treasury Diagnostics 2015.

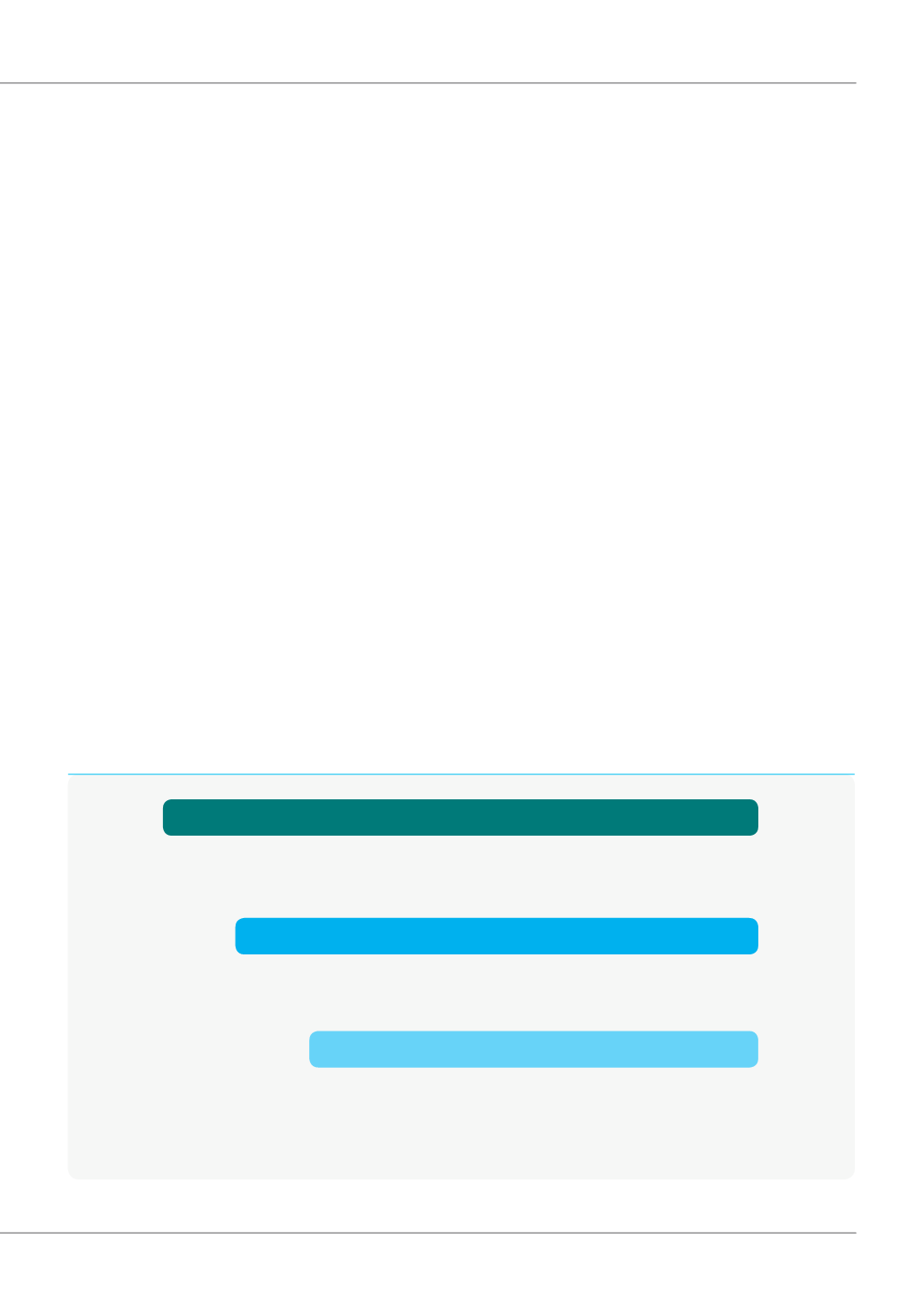

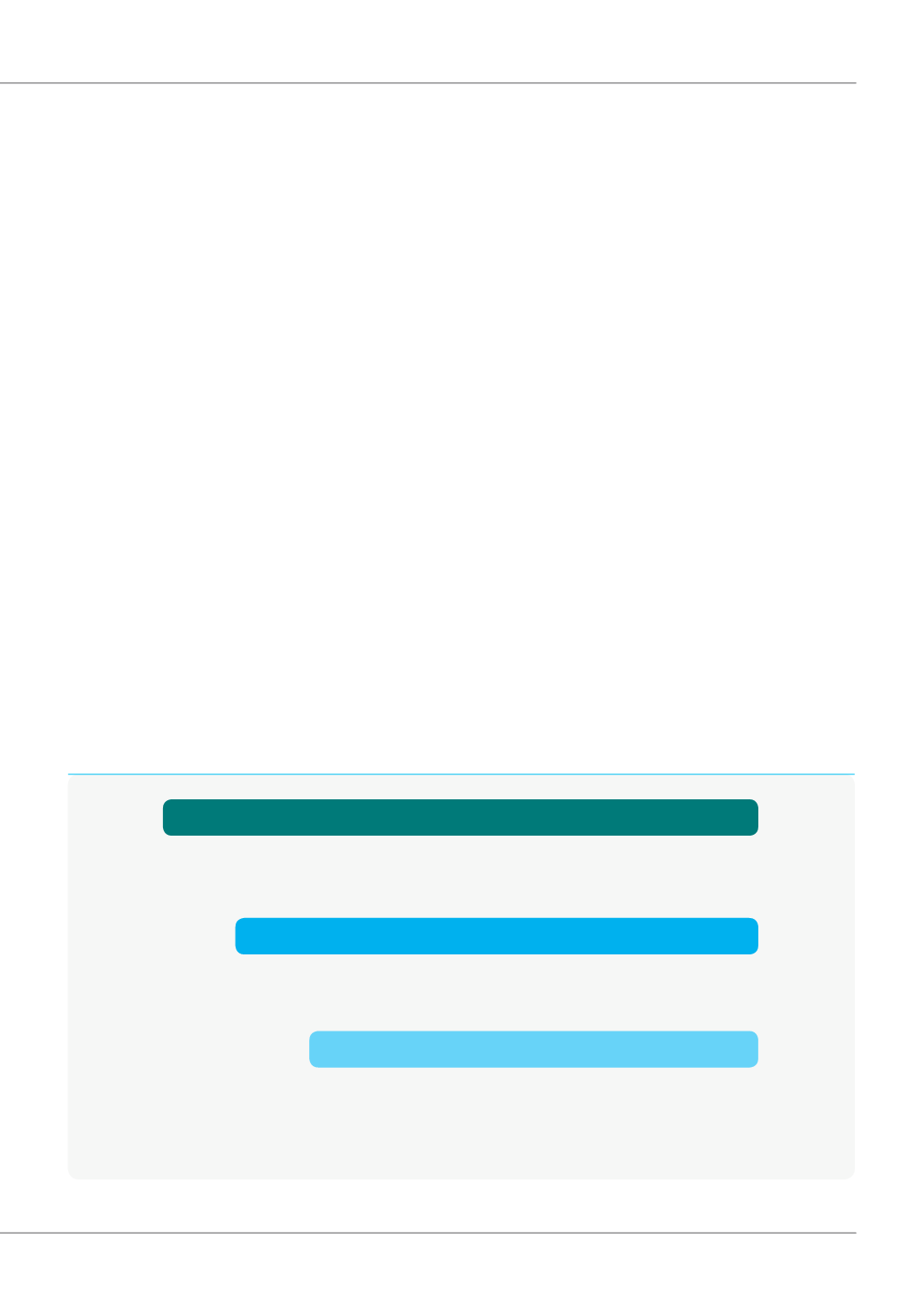

Figure 2: Treasury Centralization Delivers Tangible Shareholder Value

*

10% higher

Tobin’s Q

Market valuation of a company’s existing assets

Value Creation

Cost Reduction

5% lower

Cash-to-Market Value ratio

Reduction in cash burden

Operating Efficiency

1.44% higher

Return on Asset

Operational return (before leverage)

*INSEAD analysis of data from Citi Treasury Diagnostics