A Suite of Flexible Payables and Supply Chain Solutions

Enriching Insights. Enabling Success.

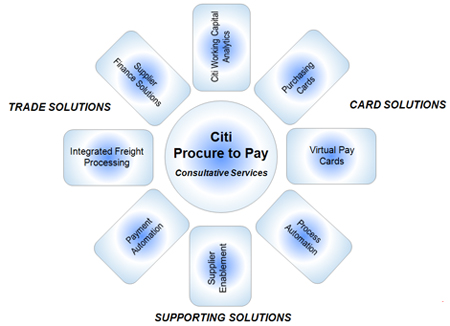

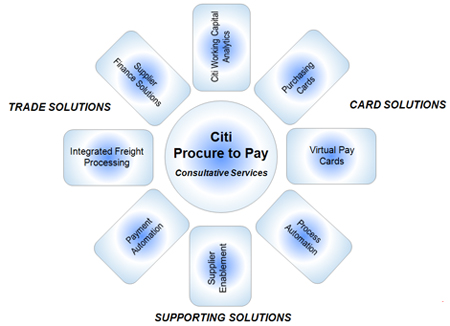

Many organizations are studying their payables and payments processes in search of opportunities to improve their performance and increase the health of their financial supply chains. Citi® Procure to Pay can help your organization to navigate the complexities of their payables environment by providing the advice, supporting services and payment tools to help organizations reach their business goals.

Citi Procure to Pay Overview

Citi Procure to Pay is a set of analytics, tools and solutions that help buying organizations and their suppliers manage the payables financial supply chain. Citi Procure to Pay uses powerful analytic engines to help buying organizations drive improved process, payment and Working Capital results. Citi’s market knowledge and solutions help organizations and their suppliers achieve lower costs, improved controls, and increased returns and optimized Working Capital.

Citi Procure to Pay Provides

- World-class payables analytic capabilities

- Decreases accounts payable costs and reduces cycle time

- Increases visibility, audits and controls across your financial supply chain

- Integrates global payment, supplier financing and card solutions

- Enhances supplier enablement tools to drive adoption and success

Solutions to Address Your Needs

Citi's suite of payables tools can be used individually to address specific needs or in combination to address your Procure to Pay process holistically.

Payment Solutions

- Citi Purchasing Cards: Used for any procurement expense, yielding process savings and cash benefits.

- Citi Virtual Cards: Citi offers a variety of highly secure AP settlement cards, allowing you to integrate card settlement into e-procurement systems as well as directly to your other AP processes.

- Payment Automation: Convert checks to electronic payments and electronic remittances, providing your partners faster, smarter access to cash, while saving you operational expenses and increasing audits and controls.

Supporting Solutions

- Citi Working Capital Analytics (CWCA): Proprietary analytics that use your payment data flows and supplier profiles to identify improvement opportunities in Working Capital Management, Payment Automation and Payable Strategy

- Accounts Payable (AP) Process Automation: Organizations can reduce invoice processing costs and accounts payable cycle times by working with Citi to examine their current processes and move to a more effective payables process. Citi assists clients in managing invoicing, workflow and payment as well as additional AP needs.

- Supplier Enablement: The Citi Procure to Pay team will leverage industry best-in-class processes for enabling suppliers across the entire payables suite of solutions. Citi understands that success in any payables solution is achievable only through supplier participation

Trade Solutions

- Citi Integrated Freight Processing: A business-to-business payment network that leverages the Syncada platform and specializes in the complicated transportation and freight- payment market.

- Supplier Finance Solutions: Leverage Citi's Supply Chain Finance products to improve liquidity for you and your supply-chain partner through sophisticated Working Capital, Discount Management, and Days Payable Outstanding strategies.

For more information about Citi Procure to Pay, please contact your Citi representative or click here.

Citi Working Capital Analytics

Optimize Your Working Capital and Increase Your Financial Advantage

Citi's powerful analytics tool provides an in-depth analysis across all spend categories to give you superior visibility and insight for decision-making.

Citi's analytical tools and advisory team can help your organization realize potential cost savings and greater efficiency within your Accounts Payable processes and in new payment and working capital strategies.

Using a suite of analytical tools available only to Citi clients, our team of analysts will review and analyze your spend data, then recommend payment methods and a strategic approach to managing your financial supply chain that will increase efficiencies and cost savings.

Citi will also outline ways to streamline your entire procure-to-pay process with modular solutions such as:

- Commercial card optimization

- Complete Payments and Working Capital Supplier enablement planning

- Buyer Initiated Purchase Card segmentation

- Citi Supplier Finance segmentation

- Electronic Invoice opportunity scoping

Information in. Inefficiencies out.

Participating in a Working Capital Analytics review is easy, and completely confidential. Your organization simply provides a data file and participates in a brief interview before Citi performs its consultative analysis. Citi will mine your organization's payables data to make specific payment recommendations; during the analysis, data can be selectively enriched to provide more targeted results. Throughout the process, Citi works closely with you to evaluate your organization's operations and provide customized analytics, reports and presentations tailored to your organization's needs and objectives.

Once the analysis is prepared, Citi will work with you to assess the recommendations, align them with products and services Citi offers and develop a step-by-step action plan for unlocking opportunities within our Commercial Cards and Procure to Pay Solutions sets.

Citi® Procure to Pay is an end-to-end financial supply chain solution that automates the collective set of accounts payable processes from purchase order to supplier payment and reconciliation. It can identify operational cost savings and opportunities to optimize working capital, as well as provide insights you can leverage to improve your audit results and control systems.

To learn more about how Citi Working Capital Analytics or Citi Procure to Pay can transform your payables strategy, please contact your Citi representative.

Electronic Payments

Electronic Payments is specifically designed to automate, integrate and simplify payables processing, allowing you to achieve all the benefits associated with paying suppliers via ACH or buyer-initiated Purchasing Card.

Benefits:

- Reduced costs of paper check processing

- Ability to leverage financial incentives such as rebates and early payment discounts

- Improved control of the timing of your disbursements

- Better visibility into your spending

- Advanced fraud protection and security features

The Electronic Payments solution features a hosted web-based Payment Gateway that provides a suite of value-added services for optimizing electronic payment workflows.

Citi Payment Gateway manages bank account data for suppliers, houses rich remittance data, and supports payments made with ACH and buyer-initiated Purchasing Cards. Buyer-initiated purchases made with Purchasing Cards mirror payments made by ACH, combining the security of ACH with the financial benefits of a Purchasing Card, including increased opportunity for rebates. Buyers can send the file directly, from their organization's ERP system, with no point-of-sale transaction required and no need to show the card to the supplier. Whether payments are made by ACH or with a buyer-initiated Purchasing Card, Citi manages the disbursement.

Payment gateway features

Citi Payment Gateway benefits:

- Comprehensive supplier enablement program that provides seamless onboarding for all your suppliers

- Management of your suppliers' bank account data for ACH payment flows

- Secure, file based Purchasing Card payments where suppliers never see card numbers

- Secure online access to remittance data for you and your suppliers

- Web-based portal for payment status and reporting

- Single file delivery for both ACH and buyer-initiated Purchasing Card transactions (In fact, we can even process your checks through the same single files for added efficiency.)

- Ability to link transactions and payments to Supplier Finance programs