6

I

Prime Custody: Achieving Asset Protection & Operational Simplicity

Remote Custody and i ts Impact on Buying Power

Calculations:

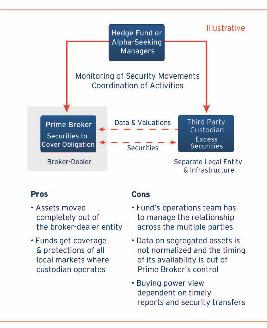

Another facet to be considered with the

remote third-party custody model is its impact on the prime

broker’s ability to calculate hypothetical buying power.

Remember, the primary purpose of a prime broker was to

extend their client’s buying power through fnancing loans

made to facilitate leverage and secured by the client’s long

positions. Prime brokers have spent millions of dollars in recent

years creating infrastructures wholly geared to the timely and

effective calculation of buying power and optimal utilization

of assets.

Unlike the traditional waterfall approach to trade and portfolio

processing around which custodians built their infrastructures,

prime brokers built platforms able to provide 360 degree views

of activity, as shown in Chart 4.

Inputs from every part of the trade and portfolio life cycle

are factored by prime brokers seeking to calculate the

buying power of their hedge fund and alpha-seeking

investment manager clients. By offoading a signifcant

portion of their assets to third-party custodial banks, prime

brokers undermine their own ability to most effectively service

and advise these clients.

Under these arrangements, the prime broker has to wait

for the custodian holding segregated assets to update their

valuations and release a report on the assets being held in their

account. This is typically at best an overnight process, and in

some instances, reports from custodians take much longer to

be updated and delivered. In rapidly moving or highly volatile

markets, this could potentially impact fund trading decisions.

Many custodians are not set up to transmit reports via

electronic formats common within the broker-dealer and prime

broker community. Oftentimes, custodial reports are delivered

via fles that must be either manually keyed or mapped into

the prime broker’s systems. This raises the likelihood of input

errors and increases the need for the prime broker and the

custodian to normalize their underlying data models—a

diffcult proposition.

Even when third-party custodians can deliver the data

effectively to support prime brokerage buying power

calculations, there are still multiple touch points to navigate

if assets need to be shifted between the prime brokerage

and custody account. Coordinating across multiple service

organizations adds time and the potential for errors into

the process.

As a full-service bank with both a broker-dealer and a custodial

banking entity, Citi has long been able to offer remote custody

arrangements for prime brokered clients if they so desired.

Rather than tout this native ability as a Prime Custody

“solution”, our approach has been to go beyond ensuring

asset segregation in crafting our offering and instead extend

to our clients a robust, seamless set of services that allow

them to ensure protection and oversee the use of their assets

in an operationally superior manner.

Advantages of Citi’s Integrated Prime

Custody Solution

Citi has an inherent advantage to many other leading

organizations in crafting a Prime Custody solution. Rather

than having to create a brand new special purpose vehicle

or employ a remote third party, we were able to combine

capabilities across two established and internal market-leading

businesses. Prime Custody is a joint venture offered by Citi

Prime Finance and by Citi Securities and Fund Services.

Chart 4: Custodial vs. Prime Broker Trade Life Cycles

Chart 3: Prime Custody via a

Third-Party Custodian