5

I

Prime Custody: Achieving Asset Protection & Operational Simplicity

Issues Emerge with Early Prime Broker

Segregation Offerings

Simply shifting assets outside the prime broker’s control and

off the broker-dealer entity into a special purpose vehicle or a

segregated account at a custodial bank solved for some issues

around asset protection and transparency, but raised others

in turn.

Early “Prime Custody” solutions were set up in one of two

ways to ensure speed to market. Very little advancement has

been made in these models since that time and most of these

solutions remain unchanged since their initial launch.

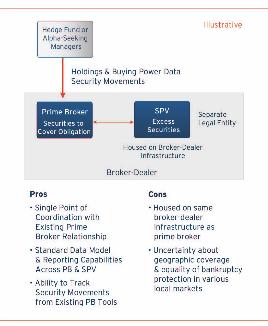

SPVs:

Some prime brokers created an internal special purpose

vehicle or trust company that segregated excess assets into a

separate account with enhanced bankruptcy protections.

This model provided legal entity separation from the broker-

dealer and allowed fund managers to coordinate their

segregated assets via the same Prime Finance personnel

they already faced off against on a day-to-day basis. However,

this arrangement left segregated assets housed on the same

infrastructure as prime brokerage accounts.

Feedback on these arrangements highlighted concerns among

investors that the segregation of assets was not remote enough

to ensure that they would be fully protected and would be able

to recoup all their assets in an orderly dissolution as part of a

bankruptcy proceeding.

The ability to ensure equal levels of asset protection across

the globe was also cited as a concern. Hedge funds and

investment managers tend to operate in multiple markets and

trade assets across the globe. This requires an ability to operate

in numerous time zones and in many markets with unique and

stringent local requirements.

Special purpose vehicles set up by some prime brokers for

custody failed to take into account the unique bankruptcy

protection laws and regulatory requirements of many markets.

This limited their effectiveness outside select fnancial centers

The SPV Prime Custody model is highlighted in Chart 2.

Third-Party Arrangements:

Other prime brokers created

remote arrangements with third-party custody banks.

Feedback on these arrangements indicated that they satisfed

investors’ need to see the assets moved completely off the

broker-dealer infrastructure, but increased the operational

complexity of managing such assets.

As part of daily operations, teams at the hedge fund or

investment manager would need to directly authorize the

movement of securities into and out of the custody account

or assign those rights to their prime broker through the

negotiation of a “control agreement”.

Control agreements are often unclear on how situations

between the prime broker and the custody bank should be

handled. When disputes arise, the hedge fund’s own operations

team often has to intervene to help fnd an acceptable path

forward. In some instances, assets have reportedly been frozen

pending resolution of such disputes, limiting the ability of the

hedge fund manager to fully utilize these securities.

Beyond uncertainty around the handling of disputes, there

are other aspects of the remote custody model that create

operational concerns. Specifcally, remote third-party custody

arrangements require that the fund’s operations team

monitors the movement of securities between custody and

prime brokerage accounts, ensures that parties meet their

transfer deadlines, monitors international accounts for actual

settlement of positions, and manually instructs and manages

the recall of securities with pending voluntary corporate

actions if the portfolio managers want to utilize those positions

in their trading strategy.

The Third-Party Custody model is highlighted in Chart 3.

Chart 2: Prime Custody via Special

Purpose Vehicle