Citi Treasury and Trade Solutions

30

The Challenge

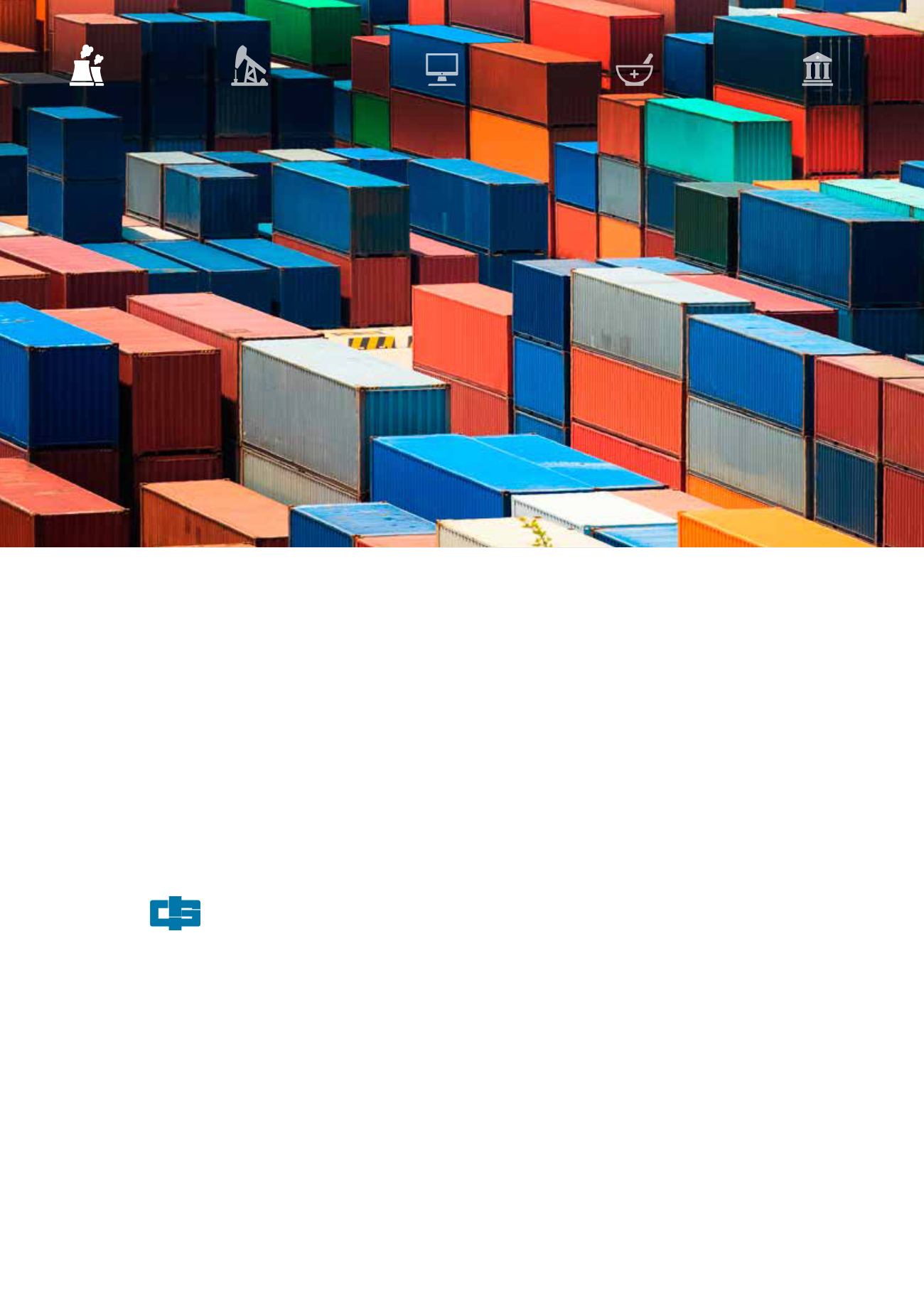

Founded in 1997, China Shipping Container Lines

(CSCL) is one of the world’s largest integrated

international container transportation, logistics

and terminal companies. The company operates

nearly 80 international and domestic trade

routes with a service network that covers Chinese

coastal areas and major trade regions in Asia,

Europe, America, Africa and the Persian Gulf.

As a flagship state-owned business, CSCL

experienced rapid growth in recent years, and

has a strong commitment to financial integrity

and transparency. Consequently, its group

treasury was seeking to enhance its financial

reporting in order to achieve more timely,

accurate and complete access to cash flow and

balance information globally. By doing so, the

company would be able to plan cash and

liquidity decisions with more confidence, analyze

cash flow trends effectively, and reduce the cost

and resources required for financial reporting.

These objectives were particularly challenging,

keeping in mind that few solutions in mainland

China are able to provide cash flow forecasting

capabilities.

The Solution

CSCL has had a highly successful partnership

with Citi for more than a decade, including cash

collections and cross-border cash pooling for its

entities in more than 40 countries. Based on this

experience, CSCL recognized Citi’s expertise in

delivering flexible and robust cash and liquidity

management solutions, and innovative

technology.

CHINA SHIPPING CONTAINER LINES

Achieving New Horizons in Cash Visibility

and Forecasting

China Shipping Container Lines Co. Ltd partnered with Citi to achieve new horizons in cash

visibility and forecasting. Leveraging Citi’s advanced cash flow forecasting analytics, treasury

now has greater visibility and insights into current and future cash flow, and has evolved into a

more strategic function within the company.

Industrials

Energy, Power

and Chemicals

Technology, Media and

Telecommunications

Consumer and

Healthcare

Non-Bank Financial

Institutions