10:53

Warsaw

10:53

New York

10:53

Kuala Lumpur

10:53

Tampa

Do you believe that you can see more than others? Do our test to check and share your score with your friends. We have ten short questions for you – answer them all to get your final score:

Success stories

Read real stories of Citi employees who started their careers as AML analysts and be inspired. Find out about people who can see more and know how to use this.

What I do in Citi is ...

In Citi I’m responsible for Global Standards and Procedures related to anti-money laundering as well as for training sessions that cover money laundering and anti-money laundering expertise.

What’s the most important for me at my workplace is...

The people I work with. I believe team effort gets the job done. Additionally, I get satisfaction from the happiness of the staff who I lead (this can only mean that I’m doing something which is right :-))

What I do in Citi is ...

What I do in Citi is manage the AML Quality Assurance teams in country Hubs based in Russia, Switzerland and Turkey.

My window to the professional world opened the moment when ...

I went to Los Angeles to take part in a project carried out in one of Citi companies - Banamex USA. The experience I gained was invaluable. I got to know about the specificity of another region and a different style of work. I learned a lot and met wonderful people who supported my development and gave me a lot of positive energy.

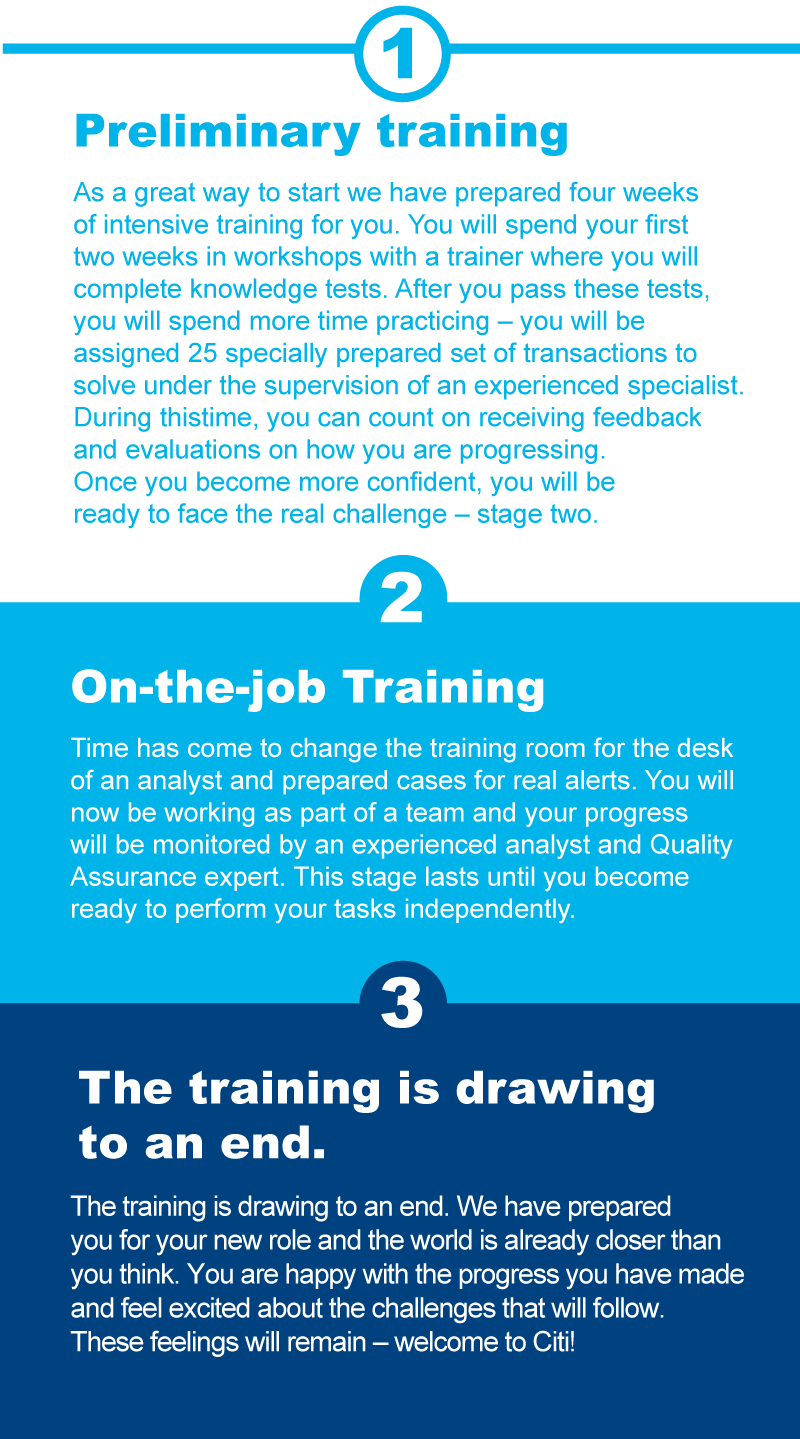

Before you start

You deserve to receive professional preparation for your new role. Find out what is ahead of you before you start.

If you don’t have AML knowledge, we will give you the opportunity to learn from the best. Before you take up a global challenge, you will participate in a cycle of professional training sessions. We will show you the AML world – starting from the basics, both in theory and in practice.

What is waiting for you?

Join us

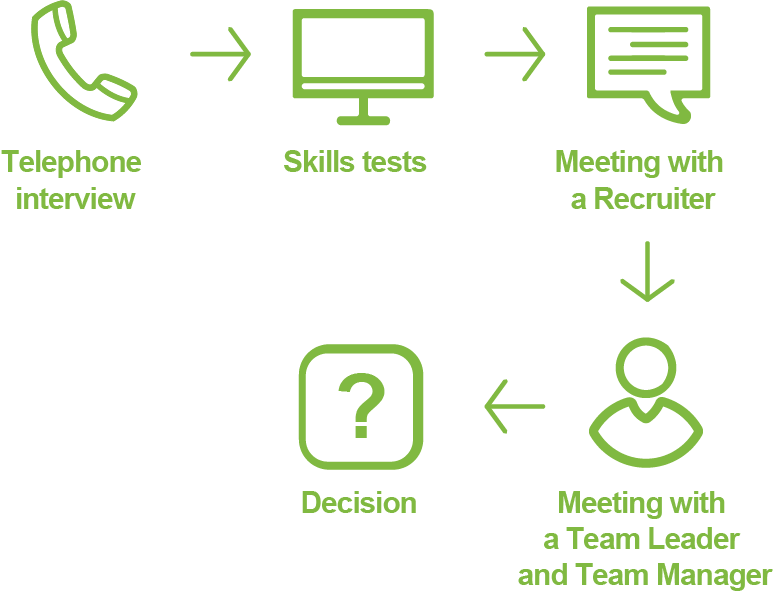

Learn more about how to apply and what our recruitment process looks like

We would like to get to know you – apply now and open your window on the world.

How to apply?

Recruitment process

AML Analyst