INSIGHTS / TREASURY & TRADE SOLUTIONS

Working Capital Efficiency Generates Significant Value

Record high inflation followed by a dramatic increase in interest rates globally has caused corporations to face rising pressures on generating economic value. In this challenging environment, focusing on operating efficiency improvements in working capital management remains a key strategic priority and driver of shareholder returns.

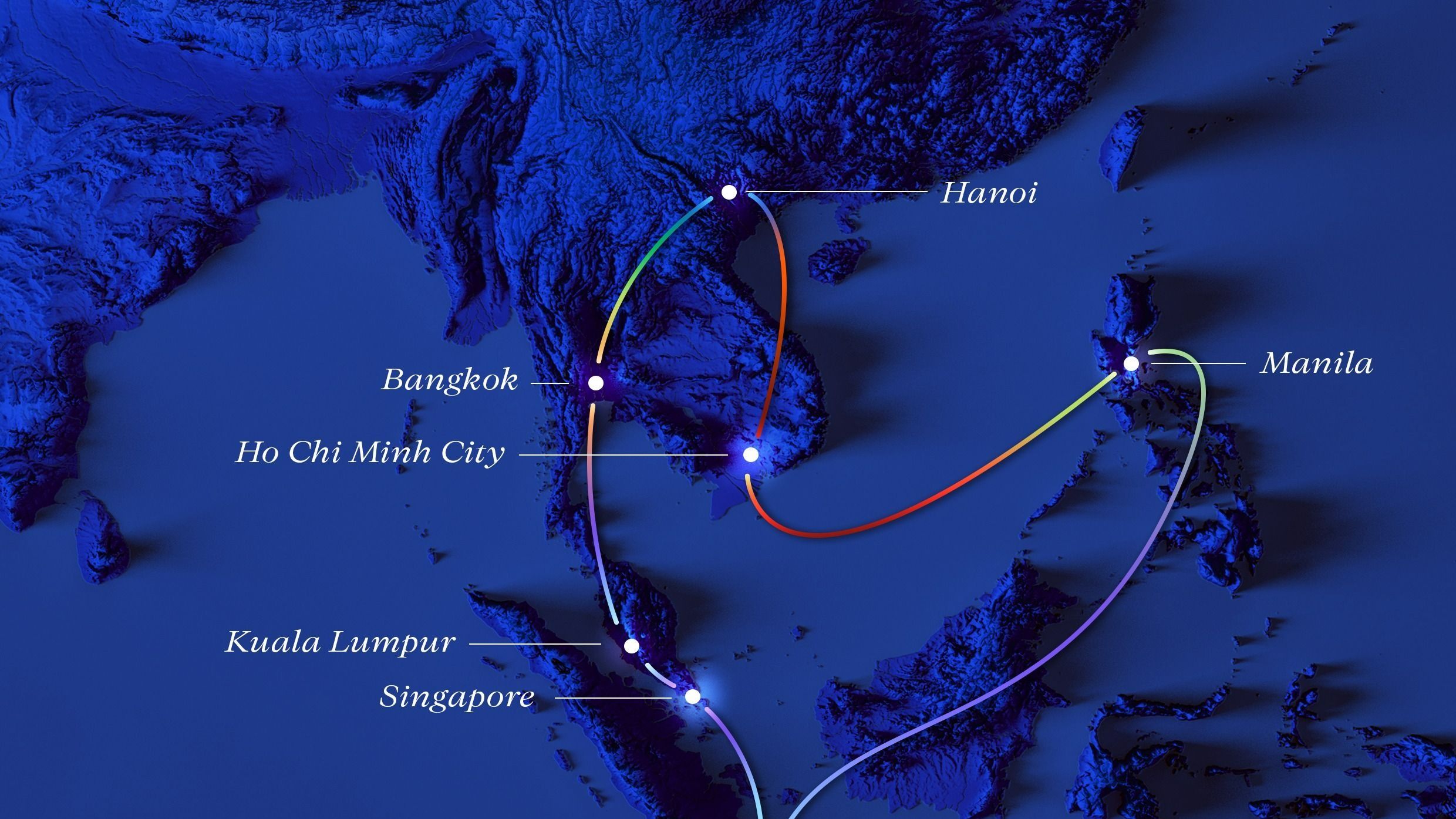

Tomorrow’s transactions

Navigating opportunities and obstacles for financial institutions and fintech companies in a fragmented region

Supply Chain Synergy

The corporate landscape across Asia has rarely appeared more complex. Companies, big and small, face significant challenges; and how they go about overcoming them will determine their success or failure over the coming years.

Author

Topic

Content Type

Keyword

Subscribe

Sign up to receive our newsletter providing a roundup of recent content and updates on new reports.

Sign up to receive the latest news from Citi.

Select Preferences