3 Key Liquidity Takeaways for the Second Half of 2021 and Beyond

Optimizing liquidity in a changing economic climate is an urgent requirement for treasurers in all industries. A recent Citi webinar, Global Liquidity Outlook: Second Half 2021 and Beyond, explores the latest considerations for liquidity management as treasurers support their companies’ growth over the back half of 2021 and start planning for 2022.

1. Recovery continues, colored by COVID-19.

Globally, positive signs of growth and recovery continue. However, the clouds of the pandemic still linger, with the impacts of new variants and low vaccination levels tampering economic levels in some markets. As the mix of growth momentum and an uptick in inflation define market conditions, central banks can be expected to initiate gradual upward rate adjustments.

Other trends impacting the global landscape include the growth of direct-to-consumer or collaborative commerce, especially notable in Asia, which accounts for 65% of e-commerce globally. Supply chain disruptions, economic tensions around the USChina relationship, and presidential elections that are on the horizon in a number of Latin American countries also will shape economic progress over the coming year.

2. Treasury’s role is key, and changing.

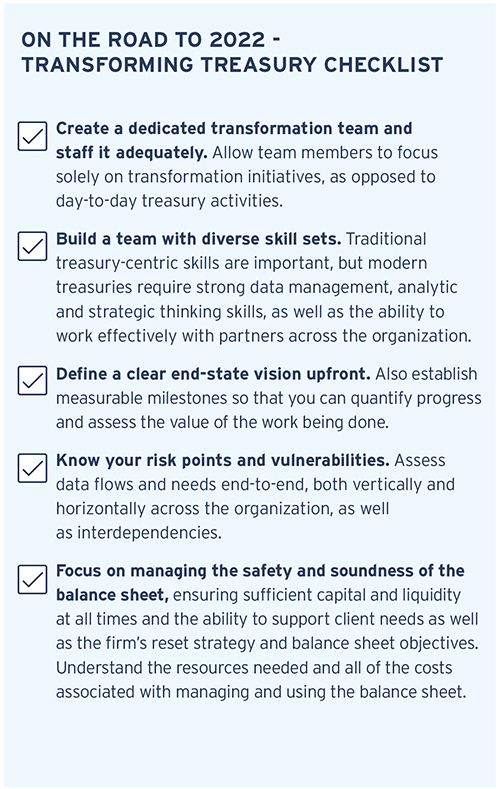

Looking back, corporate Treasurers have been keenly focused on creating efficiency. Looking forward is more about how treasury can help enable the firm’s growth. In the current environment, in particular, treasurers must manage fluctuating and sometimes unpredictable cash flows to make sure that the company’s growth engine and the client experience do not suffer.

Digitizing processes and incorporating real-time capabilities are a must, in terms of payments, reporting, analytics and funding. Deloitte predicts that real-time payments will represent 20% of global payment volumes by 2024,1 amplifying the importance of granular, accurate real-time data and standardized tools for accessing and analyzing that data.

On the liquidity side, the days of having to hedge FX risk in funding a vehicle are changing too. Flexible on-demand funding solutions are a reality in a growing number of markets, with Asia out in front. Citi recently launched Real-Time Liquidity Sharing, solution that automates the use of net available balances dispersed across multiple entities, currencies and accounts, enabling real-time lending and borrowing between pool accounts and eliminating the need for intra-day loans. The solution was initially launched in six Asian markets and is being rolled out in additional markets based on client demand.

1Deloitte, Real-time payments and implications of the COVID-19 pandemic

3. Investing goes green.

At the beginning of the year, questions lingered about whether Environmental, Social and Governance (ESG) agendas were a fad or long-term trend. Today there is no doubt. Policy makers are tightening net zero carbon emission frameworks. The price for carbon allowances are growing. Companies are setting ambitious organization-wide sustainability goals and commitments. Treasury teams, recognizing they have a role to play, are incorporating ESG factors into their investment policies.

Toward this end, banking partners are helping treasurers make sustainable investments through liquidity products that are embedded with ESG principles and criteria. In fact, 50% of the money market fund portfolio of Citibank Online Investments® is now ESG-focused, and a fixed-term Citi Green product provides a vehicle for investing short-term liquidity in environmentally friendly projects.

More recently, Citi TTS also launched multi-currency notional pooling capabilities integrated with a range of ESG Money Market Fund options. It is currently available via an automated sweep from Luxembourg-based accounts.

Bottom line, as the strategic role of treasury evolves, less time is being spent compiling a balance sheet. More time is being dedicated to implementing and using digital tools and data to analyze balance sheet trends and manage day-to-day anomalies to realize the full potential of the business and its capital.