Ecosystems: Mapping the Future Power Ecosystem

Climate Change will be the driving trend within the Power Ecosystem

Author

Kat Guanio,

Head of Top-Tier Local Corporates, Philippines

and APAC Power Industry Champion

Banking, Capital Markets, and Advisory

Climate Change will be the driving trend within the Power Ecosystem

The past decade has been a turning point in power utilities when “alternative” renewable energy has transitioned to become “mainstream”. Starting 2017, Renewable Energy contribution has gone above one-third of global installed capacity, and has continued to rise to about 36% in 2019, according to the International Energy Agency (IEA)1.

This was enabled by the confluence of innovations in infrastructure, regulatory changes, shifting support from financial markets, and consumer behavior, driven by climate change issues and more competitive cost structures.

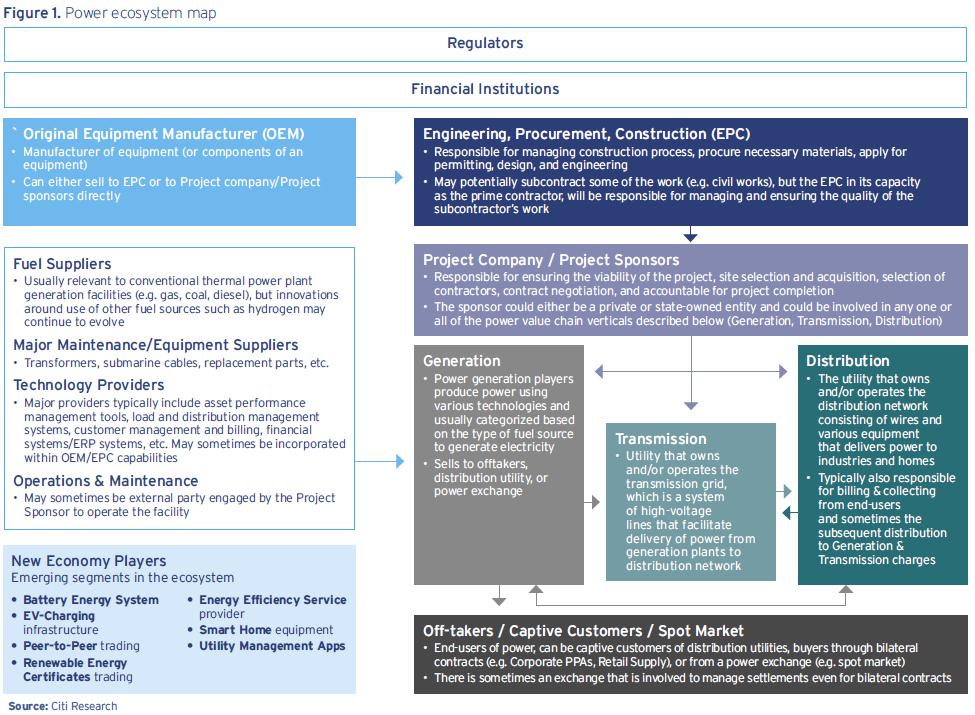

The power sector ecosystem (See Figure 1: Power ecosystem map) may be at the forefront of this transformation as a major emission-contributing sector and also a sector that is impacted by physical changes to climate. Ambitions of growing renewable energy, our power grids and distribution networks will need to be ready to ensure continued energy security and reliability of our power systems.

Low on carbon, big on investments

On the back of continuing innovations in renewable technology and rising pressure to adopt low-carbon transition strategies across various stakeholders, the IEA estimates that investments in the power sector could reach USD2.2 trillion in 20301, which is thrice from that of 2019.

More energy efficient solar panels and wind turbines continue to come to market and gain scale. Solar photovoltaic (PV) capacity2 is expected to increase to 1,300GW (gigawatts) by 2025 (vs. 700GW in 2020) and offshore wind capacity is projected to reach 160GW by 2030 (vs. 22GW in 2019).

In addition to solar, wind, and energy storage, we should also expect emergence of new forms of renewable energy such as green hydrogen, negative emission technologies such as carbon capture use and storage, and increased commercialization of grid efficiency technologies such as ultrahigh voltage transmission, smart and flexible electricity network operating systems.

An adjacent industry that would impact power systems is the auto sector with the expected continued rise in adoption of electric vehicles (EVs) which will further increase the pressure on our power networks to be ready for the upcoming surge in load requirement.

Alongside these innovations, there is an increasing need for energy storage to address intermittency issues associated with renewables and grid balancing mechanisms to ensure the continued security and reliability of our power systems.

Disruptive changes in the sector can be viewed as a threat to incumbents, but proactive utilities can embrace these changes and view them as opportunities to access new revenue streams.

Extreme weather

Extreme weather events are occurring more frequently in recent decades due to climate change. These pose significant threats to power utilities, which have cascading impact to critical infrastructure such as telecommunications, transportation, and healthcare. With increasing electrification of our economies, having a resilient power infrastructure is becoming progressively important.

Extreme weather conditions contribute to physical infrastructure stress for power utilities, prompting asset resilience investments and more robust engineering specifications such as climate-hardening measures. These may include transmission towers engineered to withstand higher wind frequency and speed, pole replacements and repositioning, upgrading of line wires, deployment of advance sensors, data analytics, load balancing equipment, and more. These resiliency investments help ensure continued reliable and safe operations of power systems and mitigate against future damage to assets, economic losses, hazards to population, and environmental damage.

Addressing the risk of extreme weather are important because these have economic and financial system consequences. Climate risk3 quickly get transposed to the financial systems by way of varying mechanisms such as loss of income and need for additional investments, which further translate to financial risks, as illustrated by the Network for Greening Financial Systems risk management framework.

The Net Zero Club

In the recent IEA-COP26 Net Zero Summit1 attended by international energy and climate leaders, it was highlighted that the focus area in coming years is to put plans into action and start delivering on plans through international collaboration and policy implementation. According to Bloomberg4, as of Feb 2021, there were over 100 countries that have pledged to reach net-zero by 2050.

‘Net-Zero’ targets are also being incorporated into corporate targets and financial strategies as these are increasingly becoming important to enable efficient access to capital, mitigate asset obsolescence, address evolving consumer behavior, regulatory, legal, and financial risks.

In an analysis5 by Citi Global Insights, it was presented that the proliferation of companies with net-zero targets across its Scope 1, 2, and 3 emissions will naturally result to a creation of a netzero bubble as businesses that commit to being net zero will be prompted to ensure that all elements of its supply chain and distribution are also at net zero.

In the same analysis, utilities ranked amongst the highest emission intensive sectors with significant ambitions to reach net zero, but the report also highlights that there is still upside for the largest players to signify commitments and demonstrate leadership in their climate ambitions.

However, certain players may not be able to adjust as quickly as others as there may be a lack of alternatives available and there may be a need for major and complex retooling of its business model and infrastructure (for example, a single coal-fired power utility). This is where transition strategies will become most relevant.

Evolving financial markets

A company’s ability to adopt to these mega trends affecting the sector will most likely impact its ability to efficiently access capital and have a major weight in determining the cost of this access. As an example, there have been a significant number of financial institutions who have curtailed its support for coal-fired power and investment managers that have set sustainability and transition focused investment strategies. Rating agencies have likewise adopted ESG rating methodologies to be incorporated into credit ratings.

There is significant momentum in financial innovation across financial services to finance and facilitate investments to support the transition to a low-carbon economy. These include green, social, sustainability, and KPIlinked bonds, loans, convertible bonds, ESG focused SPACs, investments, and transition advisory engagements.

Citi – our sustainable strategy

As the world’s most global bank, Citi is best placed to engage you in these emerging themes and advise on these real-world issues.

To demonstrate the importance of these trends, we at Citi have refreshed our commitment to sustainable progress by launching our 2025 Sustainable Progress Strategy6 advance solutions that address climate change and support the transition to a low-carbon economy.

Our strategy includes a USD 250 billion Environmental Finance Goal to finance and facilitate environmental solutions within five years in support of renewable energy, clean technology, energy efficiency, green buildings, sustainable transportation, water quality and conservation, circular economy, and sustainable agriculture and land use.

1 IEA COP26 Net Zero Summit

2 Citi Velocity - The Path to Net-Zero, Look beyond surging investments in renewables

3 Network for Greening Financial Systems: Risk Management Framework

4 Bloomberg news article – Climate Adaptation, The Benchmarks Countries Must Hit to Reach Net-Zero Emissions

5 Citi Velocity – Sustainable Tipping Points – The Net Zero Club

6 Citi 2025 Sustainable Progress Strategy