Top Priorities for Treasurers 2021: Navigating the Fog in a Digital Age

2021 is expected to be a year of rapid improvement, with near-full GDP recovery anticipated by the end of the year. Share valuations suggest investors expect robust revenue and earnings growth. Compared to the immediate aftermath of the global financial crisis of 2007-2008, large companies have the liquidity and capital buffers to pursue a mix of investment, growth, M&A, and shareholder distributions relevant to their strategies. Needless to say, this varies by industry and geography, with smaller companies typically more impacted.

Treasurers are naturally mindful of risks and the landscape of 2021 is marked with a number of uncertainties. Apart from the pace of vaccine rollouts, these include the new U.S. administration’s stance on global trade policy and geopolitics, and the knock-on impacts of sustained liquidity flow by the Fed and central banks worldwide on markets and bank balance sheets. For U.S. companies, the Biden plan potentially raises the effective tax rate by 5%-6%.1 For treasurers worldwide, while Brexit is “done,” medium-term impacts continue to play out, given London is most frequently where companies have housed their main international treasury structures. Meanwhile, as fintechs grow in the payments and store of value space, treasurers are exploring how to deal with them versus with banks.

Treasurers’ priorities are influenced by other key themes. Business growth is increasingly coming from digital business models, altering cash flow patterns and working capital needs that treasury must manage. The pandemic also highlighted vulnerabilities in supply chains. Companies are focusing on building strategic resiliency and diversification in their supply chains, while considering market exposures and the financial strength of customers and suppliers. Treasurers play a key role in risk mitigation strategies as companies restructure supply chains, optimize working capital management, and explore financing and M&A options to support their partners.

Building strong foundations

As we wrote this — the tenth annual issue of Top Priorities by the Treasury and Trade Solutions Client Advisory team — we thought about the key themes that are currently at the forefront of treasurers’ minds. What’s different this time is our approach.

After the unprecedented events of the past year, 2021 looks like it will be a reset and restart for the decade. No one could have expected what happened last year and no one can predict what will happen over the next year. So, what should a treasury focus on in 2021?

A RESET AND RESTART IMPLIES FUNDAMENTALS. AND THE ONLY CONSTANT IN LIFE IS CHANGE AND THE UNCERTAINTY CHANGE BRINGS. SO LET US START THERE.

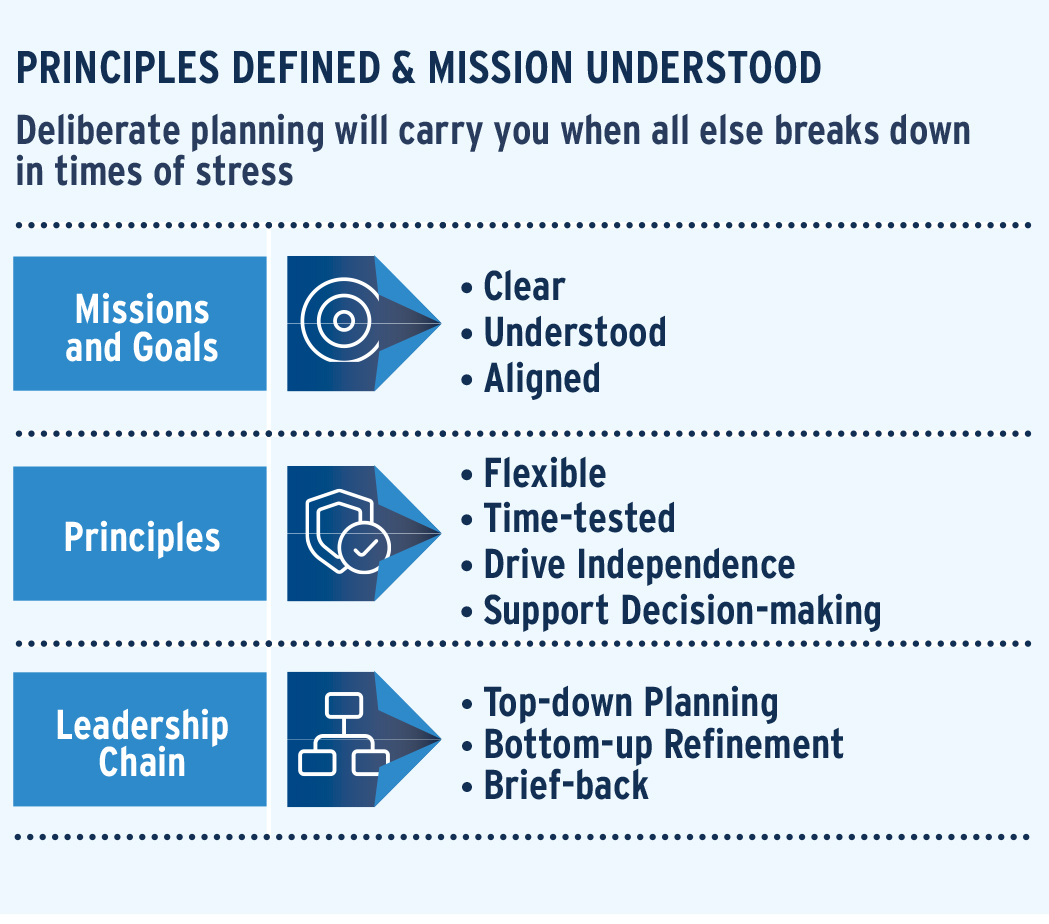

When dealing with uncertainty, situational awareness is often called managing the fog of war, or simply, the fog. Militaries employ command and control systems, principles, and intelligence (data) to manage through the fog. Companies and treasuries that managed through 2020, as best they could relative to their industries, had well-established foundations. Therefore, we see three areas treasurers need to evaluate and strengthen to manage through the fog:

- Establish a clear and defined mission, goals, and guiding principles that are communicated and understood across all levels of treasury.

- Ensure your team is well-trained and empowered to work in today’s rapidly evolving world dominated by globalization, regulations, and digital transformation.

- Adopt a treasury digital strategy centered on data.

Ensure principles are defined and mission is understood

Too often, leaders do not communicate their mission and goals. At the highest level, they should be simple and understood by all members of a treasury organization. The specific activities of each functional area within treasury should align to the treasurer’s goals. Have you asked your newest treasury analyst what are the treasurer’s goals? The effects are compounded when assistant treasurers and management do not know. Not knowing can create misalignments of purpose, activities, and inefficient utilization of time and resources. The mission and goals also need to be supported by treasury-wide team principles that cascade downwards. Principles offer clarity and direction when paired with goals once the fog sets in.

The mission and goals along with principles should stand the test of time and be applicable to most situations. This allows teams and individuals to be better aligned and act independently in the absence of rules and direction, supporting faster and more decisive action. In turn, this leads to improved revenue opportunities for your enterprise, a more efficient treasury, and better risk management.

Your newest treasury analyst needs to know the treasurer’s goals and driving principles not only for their role, but also two levels up. This can be tested with leaders engaging subordinates via a brief-back to confirm understanding. The brief-back creates an opportunity for both subordinates and leaders to learn from each other. In the case of the subordinate, they learn from senior management. In the case of the leader, they learn if their mission and principles are understood, applicable, and relevant. This allows leaders an opportunity to seek bottom-up refinement.

NOTWITHSTANDING FACTORS THAT WERE OUTSIDE OF A TREASURER’S CONTROL, ORGANIZATIONS THAT OPERATED IN THIS MANNER MAXIMIZED THEIR PERFORMANCE IN 2020 IN THE MIDST OF THE FOG.

Empowering people

The success of any organization is built on its people. How do people relate to operating in the fog? It begins with looking back to leadership. Do they know the mission and do they understand the principles they operate under? Ask yourself this: “In the absence of managers and faced with new challenges, can and do you trust your team to make important decisions that are normally reserved for senior treasury leaders?” If the answer is “no”, your team may not be sufficiently well trained and operating with principles that are flexible and adaptable in stressful situations. In essence, your team may not have the resilience needed.

To operate through the fog, team members need to have functional understanding of accounting, tax and legal regulations, information systems, and economics, along with domestic and international banking. It bears emphasis that team members need time allocated in their day for training, to address cross-functional areas that help them collaborate and develop a broader enterprise level view. These are the hallmarks we see in the strongest performers.

Maximizing these skills requires a newer area of expertise — data. Treasury professionals need to understand how data fits into a broader digital strategy and how to use that data. In 2020, we saw that treasury staff who were well rounded and with good understanding of data, and how to use that data, were able to quickly assess a complex and changing business landscape. This allowed them to develop data-led courses of action driven by shared principles, which in turn supported the treasurer’s goals during a time of uncertainty.

Data, data, data

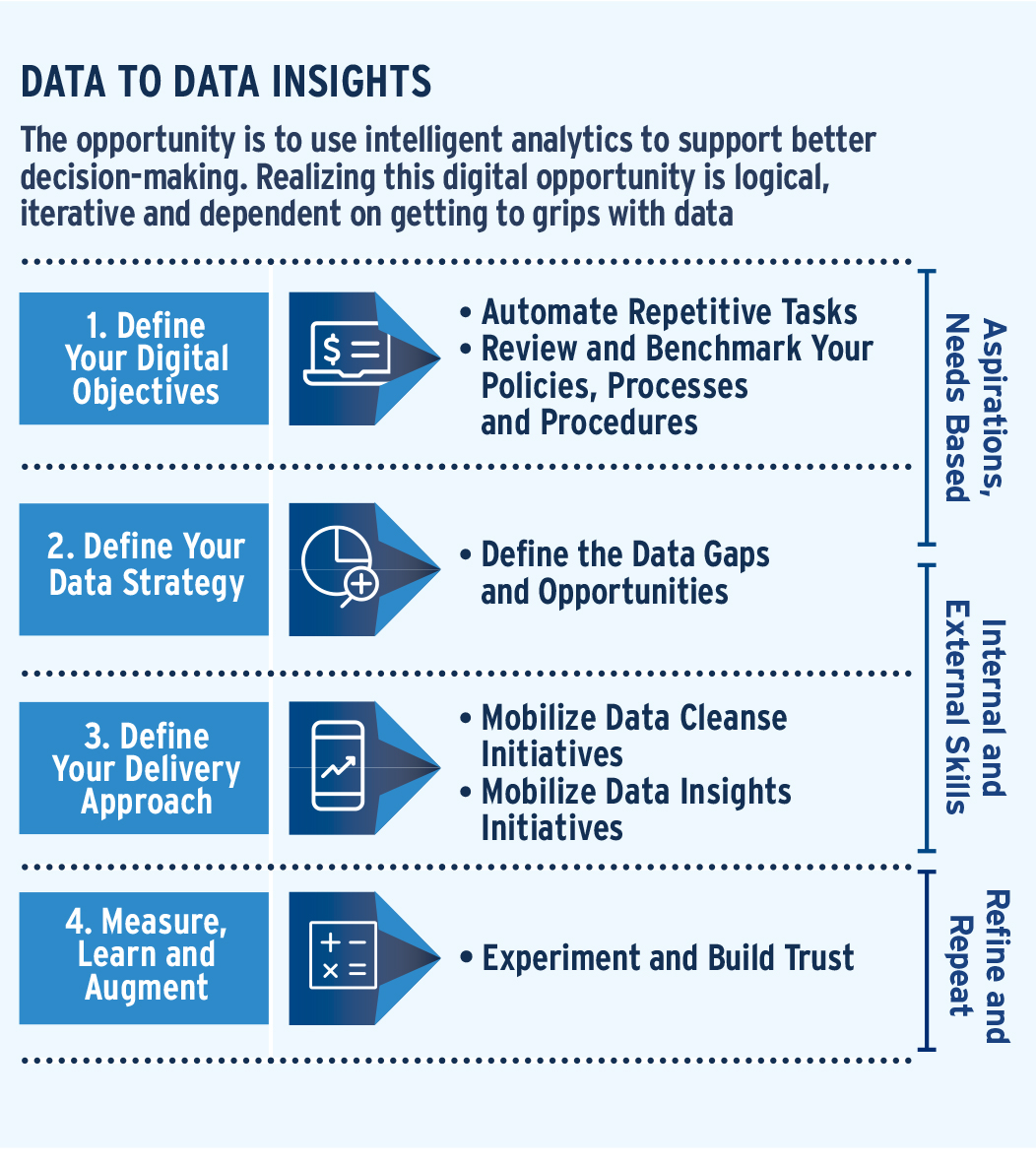

As we enter 2021, the theme of digitalization is now firmly embedded in the corporate agenda. It is no longer sufficient to think solely in terms of single-thread automation of repetitive tasks. Organizations seeking to thrive need to place sustainable resilience as a foundational principle, and build their long-term digital strategy with effective data management as the enabler.

The digital evolution of treasury is a multi-staged journey. For most organizations, it will be a transition over time from peopledependent manual processes, to basic process automation, and to adoption of predictive and prescriptive analytics leveraging artificial intelligence (AI). The last step, when trust is established in the data and algorithms through experimentation and logic nurturing, is to machines executing transactions. The use of AI augments human decision-making, equipping treasury for automated execution of “next best action” aligned with policy objectives, and moving it into a realm where timely and scalable algorithmic decision-making enables it to deliver enhanced business value.

Automation of more than routine repetitive tasks may seem a long way off for some with treasury fundamentals still needing attention. Nevertheless, the digital empowerment of treasury is coming for those who embrace the data challenge. The foundational layer to make the leap is accurate and timely data. By structuring the organization around the best possible information, not only can decisions become more effective, they can also become faster. Each company’s journey will be unique and both successes and failures will be opportunities to learn. Every company needs to explore what is possible within their corporate environment, while making sustained efforts to get past its technology debt in legacy IT and data infrastructure.

The gap between spreadsheet-based operations and an AI-powered smart treasury seems wide; and in terms of performance, it is. Yet, it’s not insurmountable. Where a treasury lacks internal resources to capitalize on opportunities around digitalization, look for partners to help make pivotal first steps in using data and smart algorithms to solve specific challenges, such as cash forecasting.

EXPERIMENT AS YOU GO, GET THE SKILLS RIGHT IN YOUR TREASURY, COLLABORATE WITH OTHERS, AND FROM TIME TO TIME REEVALUATE YOUR TECHNOLOGY AND BANKING PARTNERS — WHILE ALWAYS KEEPING YOUR GOALS IN MIND

Changing financial services

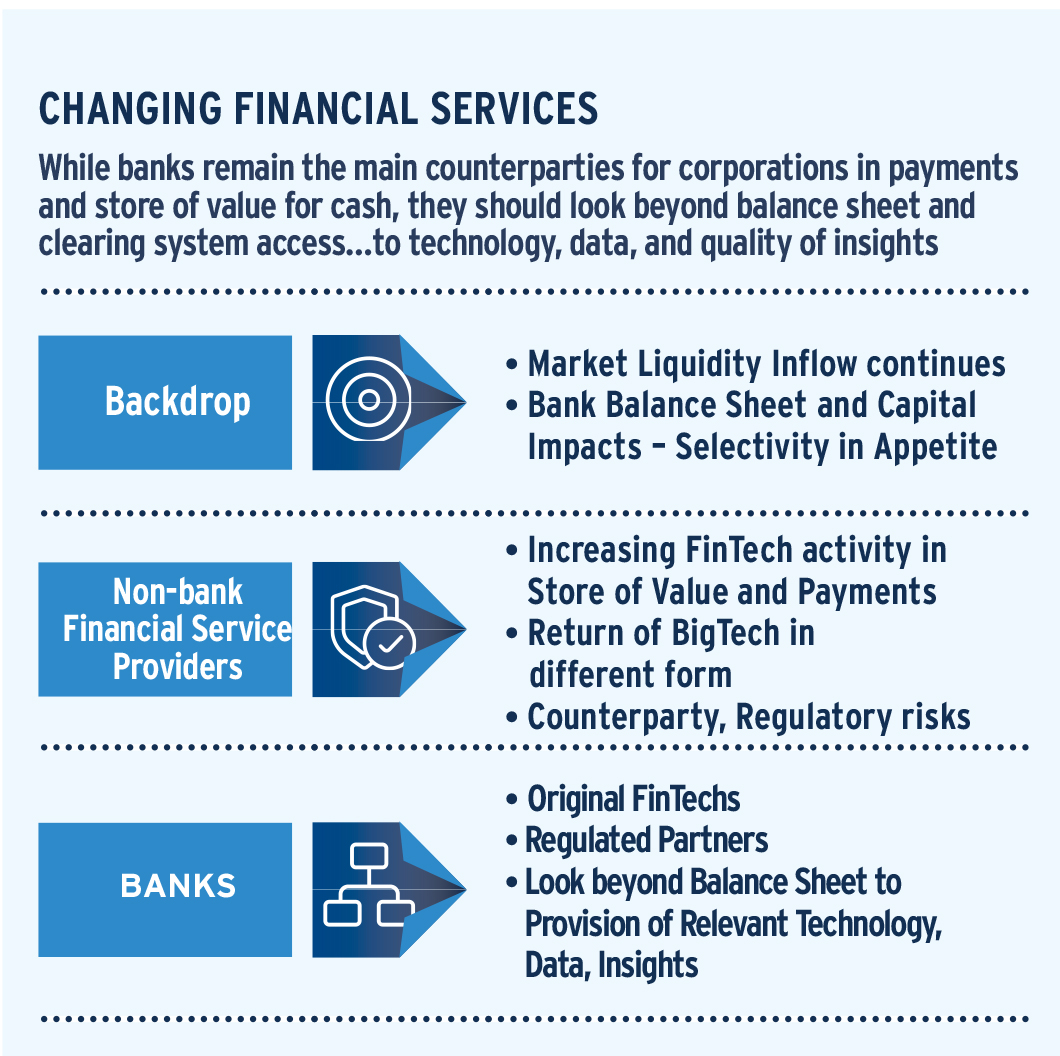

Banks are in a very different place now when compared to 2008 — in the strength of their balance sheets, liquidity reserves, and capital —in no small part due to the attention of regulators. That said, central banks’ continued injection of liquidity into the market since 2020, and the precautionary motive of consumers and companies, means that bank deposits have grown by more than can be absorbed by loan demand. Flush with liquidity, and with capital ratios impacted2 , banks are now more selective in growing deposits. That does not alter best practice for corporations, which remains leveraging global banking partners to accelerate the collection and global centralization of operating cash and placing centralized excess cash into a diversified set of investments until deployed.

2020 was also a year when there was a new plateau reached in a broader set of players —from fintechs to “BigTechs” to nonbank financial institutions —becoming more active in financial intermediation activities. This includes accepting consumers’ and companies’ cash, financing them, supporting their payments activities, providing an ability to exchange currencies, and so on.

These developments will take some time to play out. For large corporations, we do not expect an outsized appetite to deal with fintechs for reasons including counterparty risk and regulatory risk, as indeed the events in a major market bore out in 2020. At the same time, corporations should expect their partner banks to accelerate the pace of innovation by incorporating best-ofbreed technologies into their banking ecosystem, whether from fintechs or otherwise.

It is becoming clear that companies looking to the long term will choose bank partnerships for reasons beyond balance sheet provision, including backstop lines and deposit taking. Partners will be expected to provide sophisticated technologybased services that support revenue growth, data for treasurers to make better decisions, and advisory services to bring them insights.

Conclusion

Although the world economy is recovering, uncertainties abound — some old, some new, and some a realization of what was always there. This is akin to past cycles.

But, perhaps, “this time it’s different.” Let’s use 2021 as a time to rebuild the treasury foundations and consider the importance of clear goals and principles, talent, and digital strategy.

DISCLAIMER: These materials are provided for informational purposes only and are intended for institutional clients and not as a solicitation by Citi for any products or services. The materials may include market commentary, views and/or opinions of the Citi Treasury and Trade Solutions Client Advisory Group, based on reasonable analysis of information available to the group. Although the content herein is believed to be reliable, these materials and the information herein do not constitute legal, accounting, tax, or investment advice and Citi makes no representation or warranty whatsoever as to the accuracy or completeness of any information contained herein or otherwise provided.

1Source: Citi Financial Strategy Group, Jan 2021: Corporate Finance Priorities 2021

2Source: The Economist, Jan 23, 2020: Have banks now got too much cash? Some are in the bizarre position of shooing away deposits