Ecosystems: The emergence of value

Digital content services: Pivoting and succeeding in the digital-led recovery

Abhishek Bhatnagar,

Regional Solution Sales,

Treasury and Trade

Solutions, Citi

James Park,

Asia Pacific Domestic

Payments Lead,

Treasury and Trade

Solutions, Citi

Lev Kalachev,

Asia Pacific Domestic

Payments Product

Manager, Treasury and

Trade Solutions, Citi

Introduction

Live sports has been one of the industries on which the pandemic has had an unprecedented and incomparable impact.

As per some estimates, the overall impact across the sports ecosystem has been to the tune of USD61 billion1. While we have seen multiple events being cancelled or postponed, virtual sports events, online gaming and eSports have seen a huge spike in viewership as they filled the void created by an absence of live events.

- The Premier League launched the e-Premier League with professional footballers representing their teams from home. The League attracted close to 150 million viewers and was broadcast on platforms such as Facebook, YouTube and Twitter2.

- The F1 e-Sports - Virtual Grand Prix series achieved a record breaking 30 million views with more than 70% of viewership coming from digital platforms such as the official Formula 1 YouTube, Twitch and Facebook channels as well as Weibo and Huya channels in China3.

- Some popular online games such as League of Legends (LoL) boast higher viewership than some of the biggest U.S. sports leagues. E.g. cumulative finals viewership for NFL was 58 million vs. MLB’s 38 million, NBA’s 32 million, NHL’s 11 million4.

- The investment bank Goldman Sachs estimates that the global monthly audience for esports will reach 300 million by 2022, potentially surpassing even the NFL in the U.S.5

This staggering growth of eSports translates into over USD1 billion annual revenue and according to Newzoo, yearon-year average growth should be near 40% with the expectation of continuous growth6. While some fans will start returning to live events, albeit in a limited manner, the above examples point to long term structural changes in how media and content is increasingly being consumed – in digital format via digital platforms.

Background

As content consumption in digital formats continues to grow across the globe over the past few years, entertainment and information, followed by communication have been the leading drivers for user growth.

The origins of the ecosystem go back to the dot-com boom years when services such as chat, email and messaging drove initial user adoption. Businesses were more focused on gaining access to users and viewer while the monetization model was less of a priority. Over time, and particularly over the last few years, entertainment (music, video and gaming), information and communication have driven growth in consumption of content by users. Aided by the network effects of sharing platforms and proliferation of digital advertising, the digital content ecosystem has been able to allow content developers to make their content profitable. This in turn has helped the ecosystem develop operating models which help it monetize and make itself economically self-sustaining.

With better and faster devices as well as technology the data consumption across the globe will continue to rise. The number of smartphone users worldwide today surpasses three billion and is forecast to further grow in years to come). The global mobile data traffic is expected to grow much faster by five times in the next five years7.

Research reveals that starting 2020, 5G has started having a measurable impact on data traffic with nearly half of total mobile data traffic being carried by 5G. Apart from improved device capabilities and affordable data access, this growth can be attributed also to an increase in data-intensive content as well localized content.

What 2020 delivered

Strong forces were hence already at play to accelerate the consumption of digital. Then came COVID-19 which brought large changes in the behavior and habits of users and how they consume content. While the growth in internet traffic has been unprecedented, content including gaming and video had been outliers growing by 118% and 36% compared to preCOVID-198. Additionally, as a result of social distancing and lockdowns, consumers are spending an increasing amount of time consuming content at home.

Digital Ad/ Social Media

Users resorted to social media as the primary source of news and real time information as people tried to stay abreast of coronavirus updates. People increasingly moved to digital platforms as a source of information, research, productivity, and entertainment. Additionally, with large parts of the world under lockdown, social media platforms became the go-to channel for staying connected.

- Facebook added another 100 million users in Q2 taking it to 2.7 billion Monthly Active Users9.

- A large part of this growth came from APAC and India in particular. In March 2020, Facebook announced that they had witnessed twice the usual level of calls made via WhatsApp and Facebook Messenger in the days since European countries began their lockdowns.

As a result advertisers have been following customers and spending more on digital advertising. In China, where consumers spend almost two thirds of their media time online, Tencent’s digital ad revenues grew by 32% year on year in Q1 ’2010. Digital advertising has, however, taken a hit in following quarters as there is reduced spending in travel, retail, consumer packaged goods, and entertainment.

Overall, digital advertising is expected to grow 0.6% in 2020 though a number of sub-segments are expected to see a decline. Growth will come from social media, online video and search. While YouTube’s ad revenues declined by 5.8% in Q2 ’20, this was much better than Google’s overall ad business which declined 8.4%11. YouTube may hence be the driving force which helps Google recover from the pandemic.

Streaming

Customer acquisition has been accelerating, especially in paid streaming video and music subscriptions. The lockdowns across cities and countries as well as the absence of live events, sports and closure of movie halls helped drive new users. At the same time, the number of users of paid, subscription-based services has also been growing rapidly. Research indicates that Asia will have 90 million new subscription video customers by the end of 2020, with China and India accounting for more than 75%12.

Global online music streaming, globally, also grew strongly by 35% in Q1 ’20. The leaders were Spotify Music and Apple Music both of which experienced strong double digit growth in revenues and paid subscriptions13. In Asia, Tencent Music Entertainment reported a 65% year-onyear growth in online music subscription revenues in the second quarter.14

Reasons for growth also included promotional offers such as free trials and subscription price cuts in emerging markets. Innovative product innovations to tap new segments also helped drive growth – for instance new service Spotify Kids, targeting parents with small children, besides podcasts and playlists for pets. Apple Music also allowed users to share music on Instagram and Facebook.

The subscriber churn has, however, become a larger challenge for these services as more customers, who had signed up for introductory or free offers, are cancelling services and if the content does not justify the price. The emergence of free, ad-supported options has also increased the competition for subscription services.

This is particularly true for Asia where ad-supported video is the dominant model of delivering video to viewers. Asia (including China and India) is expected to lead global growth of adsupported video services with USD 15.5 billion in revenue in 2020, nearly half of the global total.

Gaming

Even before COVID-19, gaming was a bigger industry than video and music combined. The global gaming market, in 2020, is expected to be worth USD159 billion, which is more than the global video (USD43 billion in 2019) and music industry (USD57 billion in 2019) revenues. The industry’s revenue model has evolved in the past few years with recurring revenues, coming from subscription and in-game monetization opportunities, accounting for bulk of the revenues. In addition, with more direct players as well as viewers (to cover more in detail below), online advertisement has become the material part of the overall revenue dynamics.

In addition to gaming, professional eSports have seen a big spike in viewership as they fill the void left by the cancellation of live sporting events. According to Newzoo (see Figure 1), the global e-sports market will reach USD1.1 billion in 2020, in which China will account for 35%, or USD385 million.

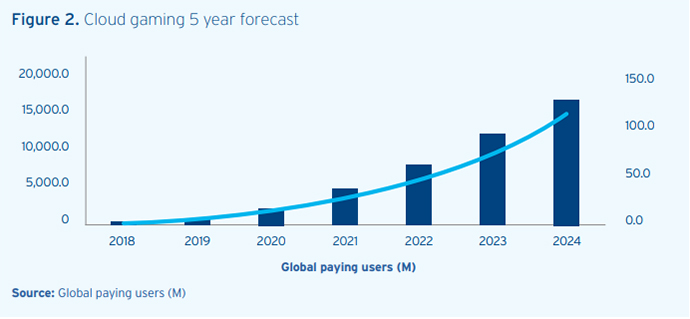

Cloud gaming has also seen heightened interest on account of COVID-19 (see Figure 2). Cloud gaming allows consumers to use hardware such as older laptops or streaming media devices, instead of expensive consoles to play graphically intensive games via remote data centers. These are typically subscription-based services.

Sony, Microsoft and Google are some of the large players in this space with Amazon, Tencent Holdings Ltd. and NetEase also announcing the launch of services. With the rollout of 5G services in several markets in Asia, telcos are providing cloud gaming options as well to subscribers. China Mobile Ltd. alone reported 11 million cloud gaming customers as of June 202015. Asia is expected to account for half of the global cloud gaming users over the next five years.

In summary, while digital businesses have seen strong growth through 2020, they have started facing a new set of challenges which is causing them to review their operating models and look at new ways of attracting and retaining users and driving revenues

What long term trends look like

1. Operating business models

a. Localization

Companies are increasingly reviewing their operating structures and putting in place local operating entities in markets where they see this offering greater benefit in terms of driving business growth and increasing market share. An increasingly challenging regulatory environment with greater focus on user privacy, content and anti-trust concerns are also some of the drivers. This will also have implications on investment in content as spending on local and original content rises.

This brings up considerations around operating entity structure, treasury and liquidity management. Companies will also need to review what this will mean from a receivables management and cash application standpoint as more local payment options are made available to their users.

b. Cloud-based platforms driven by 5G access

This will be a dominant trend particularly in the gaming space and specifically in Asia where telcos will push for new revenue opportunities to monetize the 5G rollout. In price sensitive markets such as those in Asia, this allows users access to games without having to invest in expensive hardware. Cost barriers are hence eliminated also as the subscription-based model can make it affordable to a larger user base. In Asia, the challenge which gaming companies will need to address will be that of allowing locally accepted payment options to their user base given the low card penetration in the market.

2. Product innovation and new sources of revenue

a. New and adjacent products to build and grow ecosystems

i. Facebook recently made a significant step towards maximizing its opportunities in the region by purchasing a stake in Indian mobile provider Jio, through which it will look to build an e-Commerce platform within the Indian market16.

ii. Companies will also sharpen focus on social engagement, an example being Tencent Music’s online singing rooms with interactive features which help build social connections between users. Tencent’s online karaoke product has interactive features to encourage sing-offs and has helped attracted users from upper-tier cities as well as younger demographics.

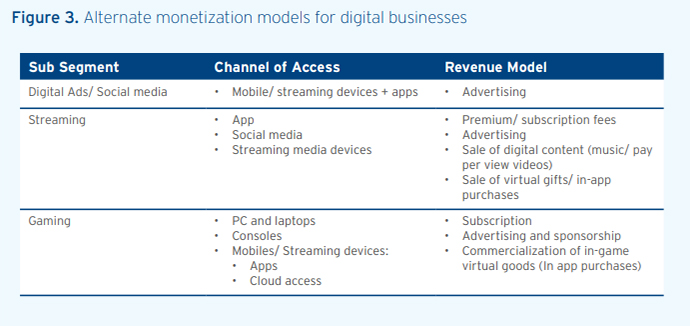

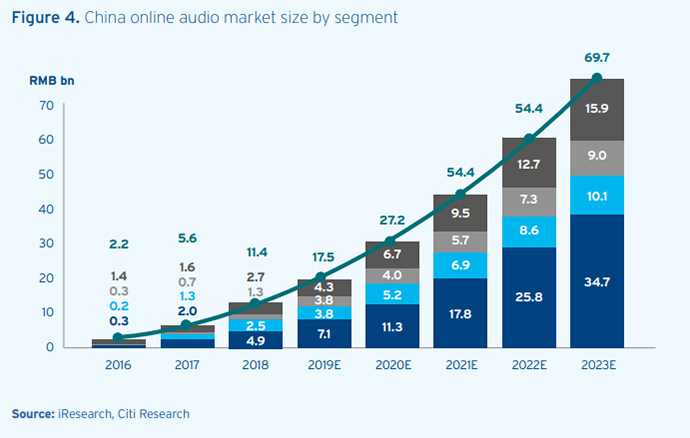

b. Walled-garden vs. open (free-toconsumer) business models Companies will need to adopt different monetization strategies to drive sales and at the same time also ensure that these are adaptable to be able to open new revenue streams in the future. While online audio platforms in the US primarily monetize through advertising and content subscriptions, in Asia, the market is expected to continue to see various monetization channels, including sales of virtual items, advertising, and content subscriptions.

Both music and video streaming saw a spike in new subscribers driven by introductory offers of free or reduced rates. It will however be difficult to retain subscribers who are likely to cancel a service if the content dries up and they the full price does not seem compelling to them. Monetization of video in South and South East Asian countries is also a challenge given the abundance of free content. Services with a flexible business models are able to retain their subscribers. In Asia we are hence seeing content streaming companies monetizing content by way of a varying combination of revenue models with advertising contributing to significantly to revenues as well.

In gaming as well, companies are increasing monetization through subscription and free-to-play models. Former is particularly applicable for cloud-based gaming as it allows gamers access to games without the need for high end hardware. Free-to-play games allow developers to monetize without users having to make up-front purchases. Monetization is via in-game upsell opportunities such as upgrades and expansion packs.

3. New sales enablers: evolving payment mechanisms drive on-demand content monetization

As companies look for new revenues streams and business models to monetize content, payment platforms and solutions will need to evolve and develop to provide support to commerce and improving endcustomer experience and not merely act as means to pay. To monetize content, both by way of subscription as well as in-app purchases, players will look for providers to offer a more seamless payment experience and add value in various ways including:

- Access to a wide range of locally popular, payment options beyond credit cards. As the digital economy has boomed, banking regulators in most markets in the region have upgraded their clearing systems to support instant or fast payments. Such payment schemes also allow a lot of data to be transmitted potentially preventing fraud. Banks as well as other providers are developing services that run on these rails and which allow users to move money seamlessly.

- Alternative payment method (APM) acceptance. Given the local card penetration in Asia, APMs will continue to capture a growing share of transactions. It hence is critical that companies allow users to pay using APMs, in addition to paying from bank accounts.

- Improved authorization rates and reduction in rates of payments decline and fraud which have huge ramifications on customer experience.

How to monetize in the new world

As various emerging trends highlighted above impacted businesses’ operating models, more relevant pricing strategy and efficient monetization models powered by banking partners are being introduced.

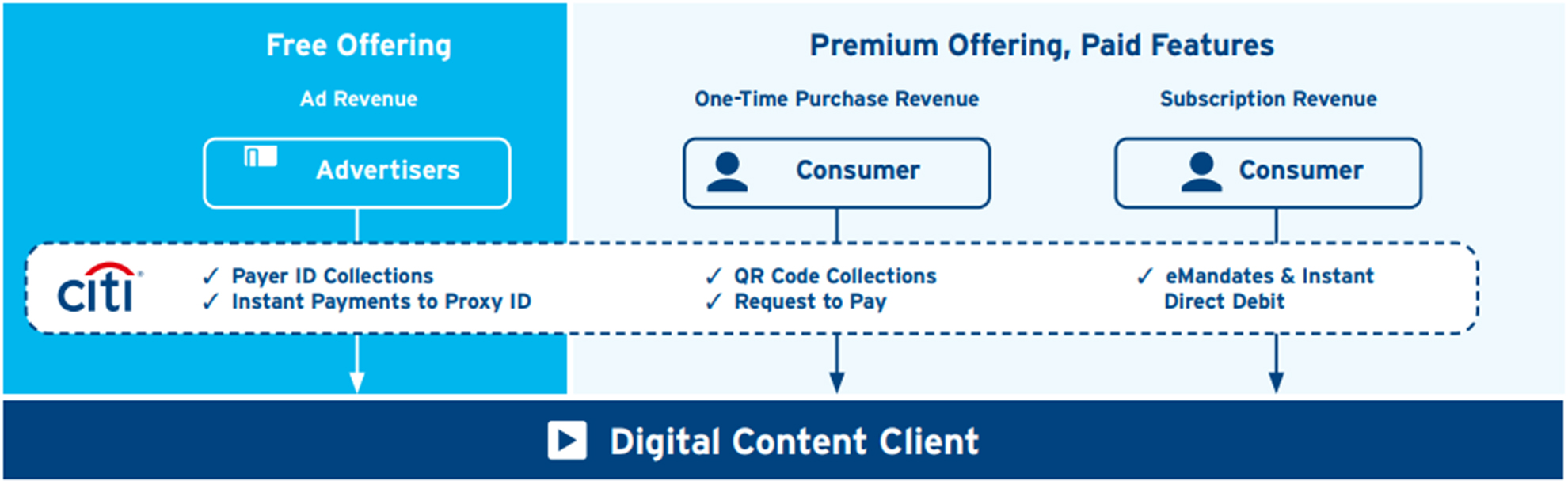

A good example to highlight this section is how many digital content players adopt a “Freemium” revenue model which is segmented into two sub-models:

- free services to drive the adoption by offering basic or intentionally-limited functionality.

- one-time purchase or subscription services to offer more comprehensive and seamless experience. Free services also can make revenue from pop-up advertisement that shows up during content streaming.

Revenue from advertisers is normally collected via traditional banking channels like domestic and crossborder fund transfers. In order to collect revenue from the consumers, both onetime and subscription, digital content players have been mostly relying on credit cards (online) and gift cards (sold in stores) which has allowed these companies to collect all over the world as well as reach to consumers without credit cards, however all at a very high cost.

As companies seek to both localize and explore new revenue collection methods, there is a significant opportunity to tap into wide range of solutions emerging from rapidly evolving instant payments infrastructure around the world, which can be powered by your banking partner, Citi.

Depending on types of pricing strategy and monetization plan, the most suitable collection solution must be considered:

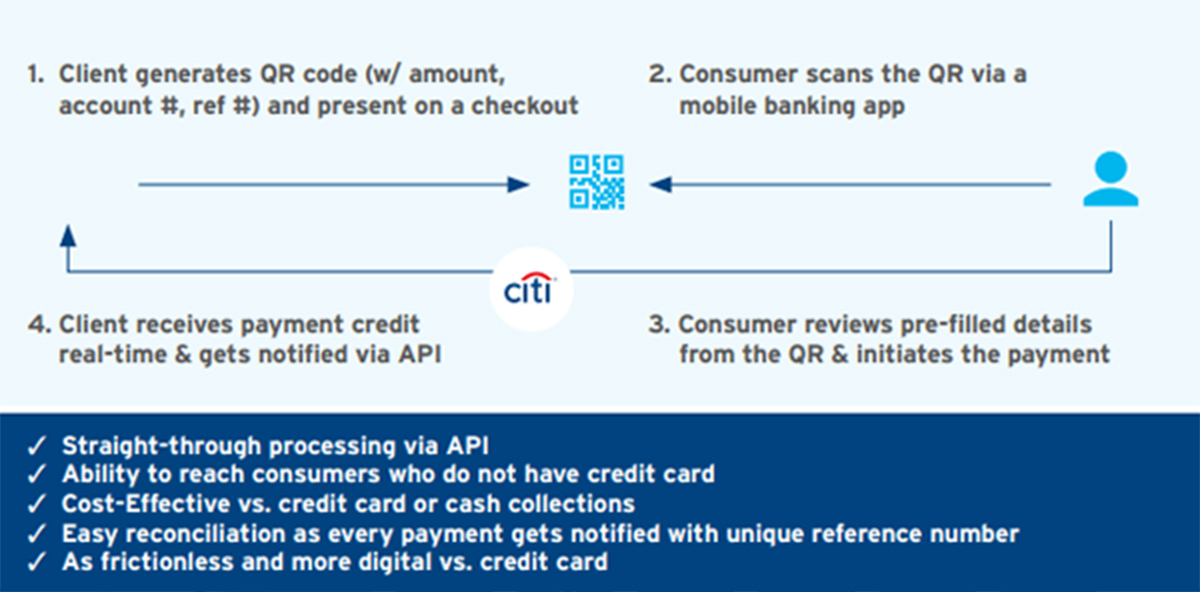

QR Code Collections for one-time purchase

Merchants can generate a QR code containing all the relevant transaction information including account number, amount and reference for easy reconciliation. Users simply need to scan the QR code using mobile banking app and authorize the payment. If shopping on mobile, instead of scanning the QR code can be easily downloaded from merchant’s checkout page and uploaded to the mobile banking app. Once payment is sent merchant will be instantly notified via API and can confirm the purchase to consumer.

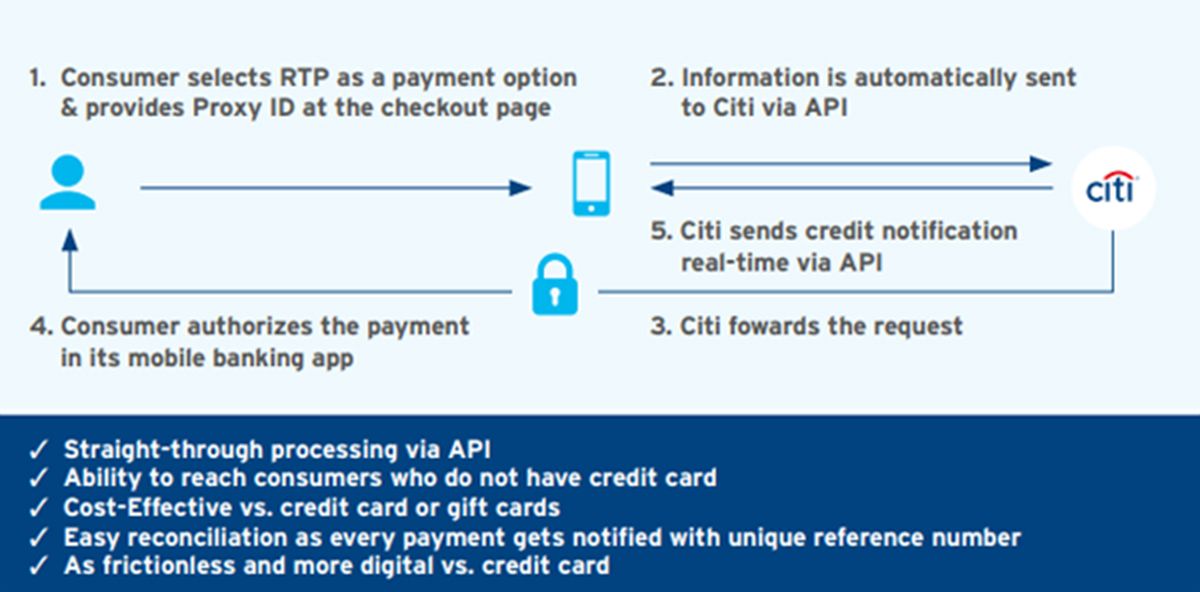

Request-to-Pay for online purchase

Request-to-Pay is a collection method that allows merchants to send a collection request directly to consumer’s bank. All that a consumer has to provide is a proxy ID (email, mobile #) registered with the bank. Once the Request-to-Pay is initiated, consumer will receive a notification from their banking app to authorize a collection. Once authorized, payment is sent and merchant will be instantly notified via API and can confirm the purchase to consumer.

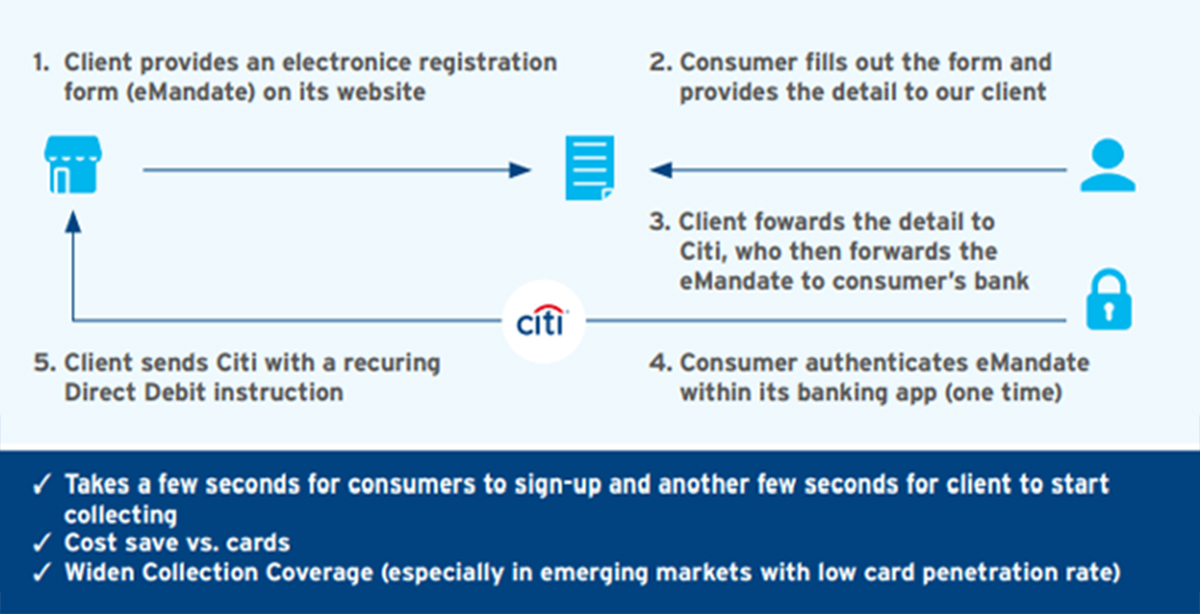

eMandates & Instant Direct Debit for subscription-based collections

Traditionally direct debits (autopay) have always relied on a physical mandate signed by the consumer, which was never a viable option for digital native companies. The introduction of eMandates allows merchants to place a simple form on their website for consumer to fill out basic information including account number or proxy ID (email, mobile #) linked to the banking account. Once submitted consumer will receive a notification from banking app to authorize the eMandate and from then on merchants can pull the funds from consumer account instantly. can pull the funds from consumer account instantly.

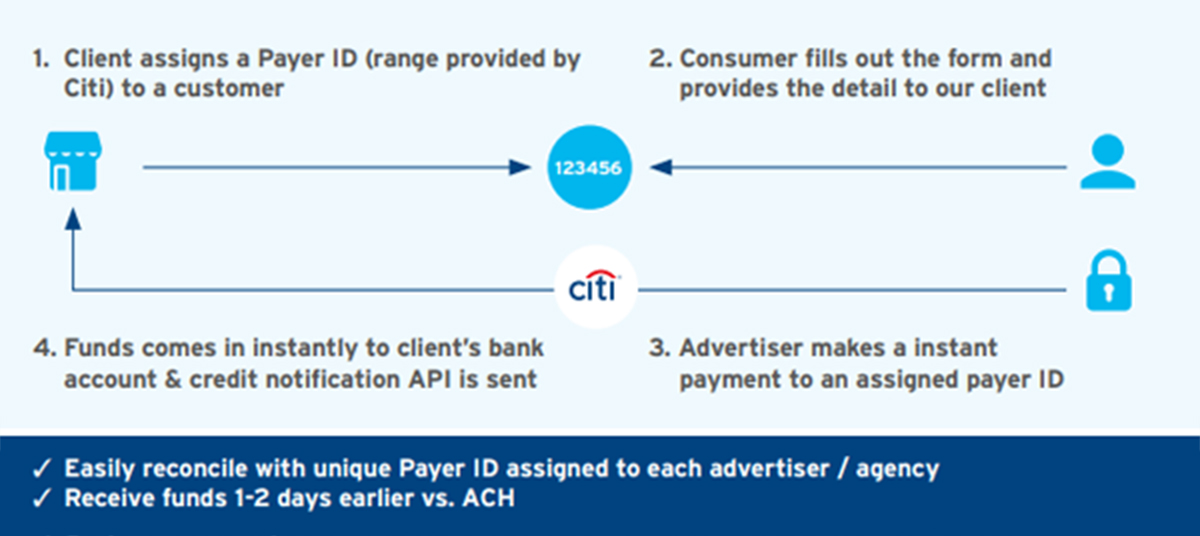

Instant Payer ID Collections for B2B collections

In order to streamline the reconciliation of ad revenue collections clients can assign a unique Payer ID to each advertiser / agency. When payment is made into a Payer ID the funds will be transferred to client’s account with Payer ID as a reference which can be simply mapped to find out who is the actual payer.

Cost saves and wider collection reach

To summarize, by localizing and by shifting from credit card collection and gift cards to instant collection solutions digital players can achieve significant cost saves and extend their collection reach to anyone who has a banking account. Beyond that, ability to receive funds into the account few days earlier has a positive impact on working capital and various company metrics. While it may not be feasible to completely eliminate collection via gift cards given that some of the consumers are not eligible for a bank account due to age, significant cost saves can be achieved by shifting even a portion of that revenue collection to digital alternatives like QR Collection and Request-to-Pay for consumers who have a bank account.

1 The Future of the Sports Industry, Mediacom Sports and Entertainment, May 20202 https://groupmp15170118135410.blob.core.windows.net/cmscontent/2020/06/The-impact-of-COVID-19-on-sport.pdf

3 https://www.formula1.com/en/latest/article.formula-1-virtual-grand-prix-series-achieves-record-breaking-viewership.7bv94UJPCtxW0L5mwTxBHk.html

4 Goldman Sachs

5 The World of Games – eSports, From Wild West to Mainstream, Goldman Sachs

6 https://www.visualcapitalist.com/how-the-esports-industry-fares-against-traditional-sports//

7 Ericsson Mobility Report, June 2020

8 Netflix 1Q ’20 Earnings call

9 https://www.socialmediatoday.com/news/facebook-adds-100-million-more-users-reports-11-revenue-growth-amid-covid/582653/#:~:text=First%20off%2C%20 on%2users%20%2D%20Facebook,amid%20the%20COVID%2D19%20lockdowns.

10 https://www.weforum.org/agenda/2020/06/coronavirus-advertising-marketing-covid19-pandemic-business/

11 S&P Market Intelligence

12 https://www.screendaily.com/news/how-asias-streaming-landscape-has-been-transformed-during-covid-19/5151836.article

13 https://www.counterpointresearch.com/music-subscriptions-394-million-q1-2020/

14 https://ir.tencentmusic.com/

15 S&P Market Intelligence

16 https://edition.cnn.com/2020/04/22/tech/facebook-india-reliance-jio/index.html