Demand for Real-time Services - A Pulling Force

Authors

Joseph Vasen,

Principal, Treasury Advisory Group, Treasury and Trade Solutions, Citi

William Artingstall,

Director, Emerging Payments and Business Development,

Treasury and Trade Solutions, Citi

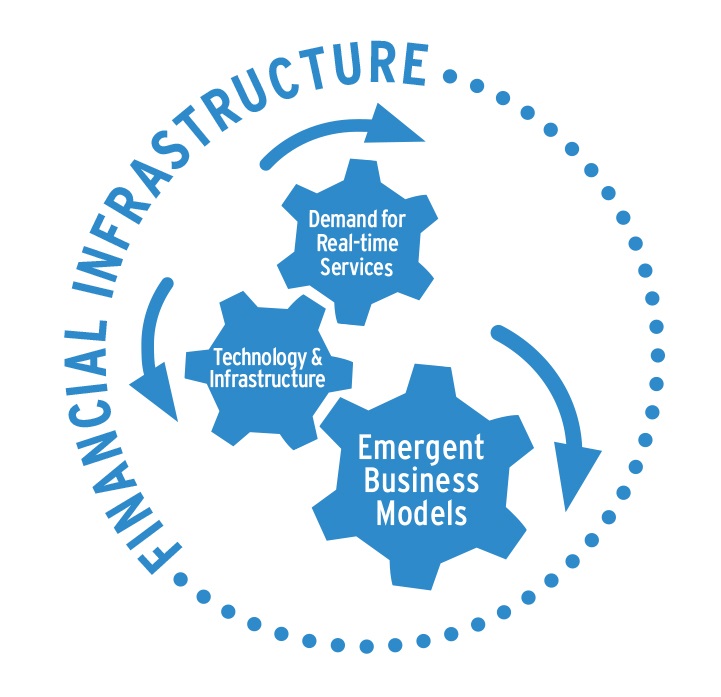

This is the second of a six paper series in which we explore the concept of real-time treasury. Our first paper defines real-time treasury as the evolution of banking, liquidity, technology, and payment systems. These elements operate in continuous motion and impact all of our organizations. We introduced four forces that we believe are shaping real-time treasury: demand for realtime services, technology and infrastructure, emerging business models, and financial infrastructure. This paper examines the first force, the demand for real-time services, in more depth.

Demand for real-time services is determined by buyers, sellers, regulators and other market participants whose interactions and involvement create the need for real-time banking services. In some cases, government bodies and regulators create the pull for real-time banking through schemes and legislations like open banking which allow realtime technology organizations to become participants. In other cases, buyer and seller interactions change as a result of new technology and create a demand for real-time services. The organizations who take advantage of real-time services often operate at the leading edge of the global economy. When will your organization be subject to this demand? How will your organization need to adopt the principles of real-time treasury?

“WHILE IT IS IMPOSSIBLE TO ACCURATELY PREDICT THE TAKE-UP OF REAL-TIME TREASURY SERVICES, IT IS LIKELY THAT WITHIN THE NEXT FIVE YEARS — AT LEAST WITHIN MAJOR CURRENCIES — REAL-TIME ACTIVITY WILL BE A REALITY FOR MANY GLOBAL CORPORATIONS.” Tony Masone — Treasurer, Amazon

Interactions through real-time mediums

Technology as a medium continues to have a significant impact on interactions between buyers and sellers. When thinking about demand for real-time services, we might first look at the channel. The channel refers to how sellers deliver products or services, how buyers and sellers access or engage with each other, and how sellers communicate with buyers.

Buyers want to deal with sellers seamlessly, in real-time. In turn, this creates a knock-on effect and the demand for real-time treasury. Operating in real-time can be a key differentiator that determines why a buyer picks a particular seller. Not operating in real-time and hence being unable to meet buyer demands rapidly, is a reason why a seller might look for an alternative. Many organizations deploy an omni-channel strategy which supports a seller’s preferences for how they access products and services creating additional complexity. While we see this rapid evolution with the growth in adoption and utilization of online channels, mobile apps, marketplaces, and the rise of e-commerce platforms, we believe an omni-channel approach will remain relevant for some time and service speed in a brick and mortar environment is just as critical.

We could debate that the buyer’s preference is more important than the medium through which they interact with a seller. While this may be true, we believe that it remains a second order factor in terms of the impact that drives real-time treasury practices. For this reason, we feel that the focus should remain on how the mechanisms of interaction influence the real time-nature of an organization’s treasury.

Why should treasury care about immediacy? Treasuries need to consider buyer interactions as buyers purchase and receive goods and services. This change in interaction to real-time mechanisms means that confirmation of payment settlement, or at minimum future settlement, triggers the supply chain to deliver a good or service. This requires treasury to provide real-time information used in the reconciliation and confirmation of funds by both buyers and the business lines that treasury supports. If treasury can predict the services the business needs and proactively implement them, treasury becomes an enabling force and not a bottleneck.

With the channel influencing buyer and seller interactions, sellers need to deliver goods and services in real-time in order to actively engage buyers. To make this happen, the interaction requires real-time logic, banking, liquidity, technology, and payment systems. What does this mean for treasury; what considerations matter?

- The way buyers and sellers access goods and services drives more frequent interactions with sellers.

- Buyers’ minds thrive on the thrill and experience they get from walking into a store and walking out with a product. Stimulating interactions with this strong sense of immediacy is a key aspect of a buying experience in both online and offline channels.

- Channels exacerbate the need for instant gratification when considering most buyers have multiple channels at their fingertips and expect the same experience for each channel.

“PREDICTABILITY IN THE CHANNEL IS IMPORTANT. VEEM’S CLIENTS NEED TO KNOW WHERE A TRANSACTION IS IN REALTIME. REAL-TIME REPORTING PROVIDED BY PARTICIPANTS IN THE VALUE CHAIN IS OFTEN HIT OR MISS. REAL-TIME REPORTING EITHER ENABLES OUR BUSINESS OR ACTS AS A CONSTRAINT.” Pramod Iyengar — Chief Financial Officer, Veem

Frequency of Interactions

The number of interactions between buyers and sellers within ecosystems is also increasing. Businesses need the ability to cope with a greater volume of commerce that moves at a higher velocity. The volume of transactions impacts more than just people or system capacity; treasuries must collaborate with their in-business partners to address liquidity management, settlement and reconciliation processes, while addressing the practical constraints and restrictions that exist. The perfect scenario might be straight through processing with real-time settlement and reconciliation from the user interface, through the bank account, and back into the accounting system at any time that suits the buyer, i.e. 24x7. But this requires resources along with efficient and no-touch processes, which help reduce queries and service requirements, as well as system and infrastructure requirements.

Availability: If the heightened requirements around immediacy and the frequency of interactions isn’t enough, the complexity is compounded when businesses employ an omni-channel strategy to deliver goods and services. This exists beyond just the digital space — we see many traditional businesses adding new channels. Physical brick and mortar channels are just as important as online channels in real-time. The truth is buyers determine the channel of preference, which creates the need for businesses to enable real-time and frequent interactions that are critical in maintaining and reaching new buyers. The real-time use cases may be more obvious for direct to consumer business, but we see corporate practitioners in traditional wholesale businesses that have expressed fear of missing out on some epiphany where the world will pass them by

Knock-on Effects to Treasury

With technology acting as an enabler for change in buyer and seller interactions we see both the velocity and frequency of interactions increasing. This creates a knock-on effect that drives the velocity of money and creates a need for real-time information and reporting. This in turn drives the need for deeper levels of automation and rule based approaches in treasuries as people centric process simply can’t keep pace. For treasuries, this means that planning processes, system integration, and real-time transaction enablement is becoming increasingly multi-faceted and increasing system centric.

Thinking About Tomorrow and Working Today: The modern real-time treasury needs to support the shift in demand for real-time services and reimagine what their systems and processes will look like. Treasury will need to plan ahead to meet business expectations for immediacy, increasing frequency of interactions, and the utilization of multiple channels to deliver a product or service.

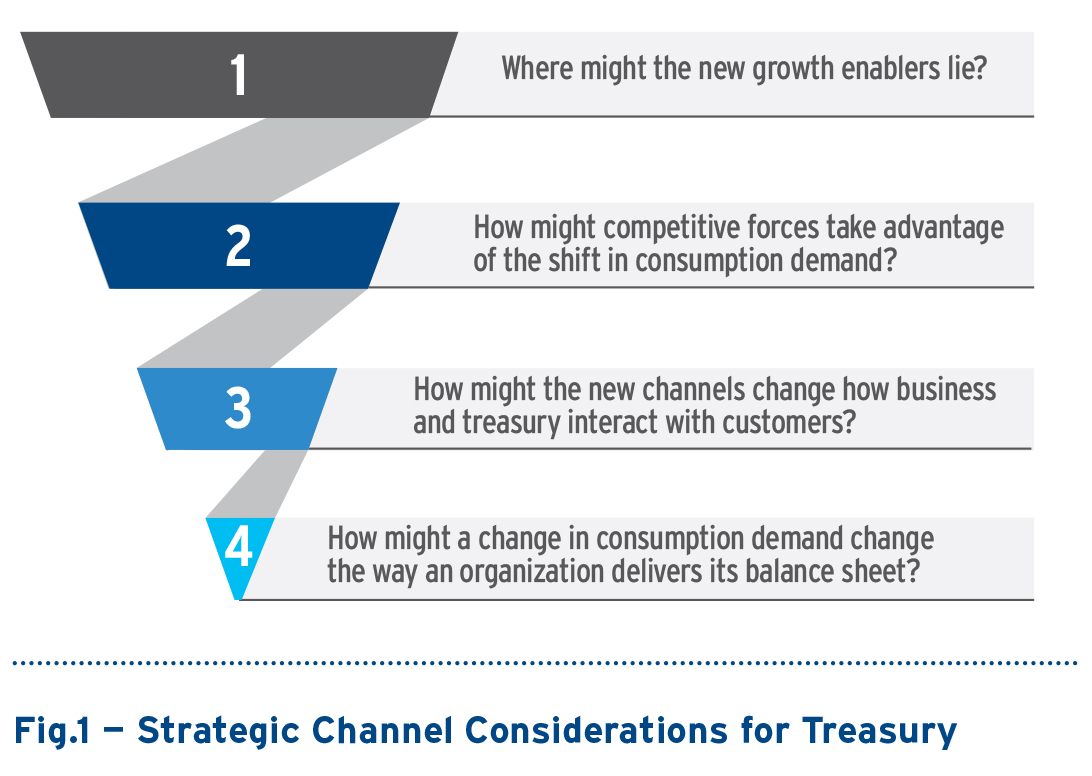

We believe that, at this juncture, it’s critical for organizations to establish a strategy or at the very minimum, pillars of a strategy to assess their own real-time treasury needs, and we see the following considerations as a way to narrow focus:

All businesses differ and will evolve to meet the demands of real-time treasury at different paces. Many countries mandate real-time payments and most banks are implementing their application programming interface (API) strategy to harness data and improve buyer experience. The data passed by the API forms the foundation of treasury digital strategies. Liquidity and the ability to operate in real-time lags in its capabilities. Central banks, currency controls, end-of-day cash operating and reporting cycles, missing data and technology, all cumulatively impede treasury’s real-time journey. We will discuss these elements in greater detail as we write about financial and technology infrastructure.

We have listened to clients who have told us that real-time does not impact them. When probed, client views show more nuance. Real-time subtly impacts them and will likely play a bigger role in the future. Any Citi client has the ability to operate in realtime and is likely currently doing so in some degree. It is our view that treasuries should assess their business models to see where they currently operate in real-time and where their business partners might require them to operate in real-time. Not helping to shape your organizations’ real-time treasury strategy will at best, position treasury as simply a service used by the enterprise or worst, as an impediment.