Embedded trade: the future corporate experience

Luis Valdich,

Citi Ventures, New York

John Mazzara,

Citi Ventures, London

Xiaolei Cong,

Citi Ventures, New York

Opeyemi Olomo,

Treasury and Trade Solutions, Dublin

For some time now, there has been a drive towards the bundling of services in order to modernise and enhance global trade processes. While bundled services – usually via online platforms – have become common practice for industries such as telecoms, global trade has remained behind the curve, with paper-intensive processes continuing to handicap any drive towards digitisation and therefore greater efficiency.

The coronavirus pandemic has turbo-charged the move towards wider digital adoption in the trade ecosystem. This digital evolution started a few years ago with various digital freight models emerging, making the time now ripe for “embedded trade” to become part of the trade ecosystem – offering a seamless way to integrate physical (such as the ordering and shipping of goods) and financial supply chain activities (such as the financing for the shipments) onto one platform.

Embedded trade not new

Embedded trade is not a new phenomenon. Significant strides have already been made to enhance transport logistics. Fintechs within the shipping industry, for instance, have created trusted marketplace platforms that unite shippers and shipping companies – matching supply and demand to help streamline the preparation, transportation and receipt of goods. These innovations have been successful, with shipping companies increasingly able to allocate orders along the entirety of a shipping route – in effect, optimising their activity.

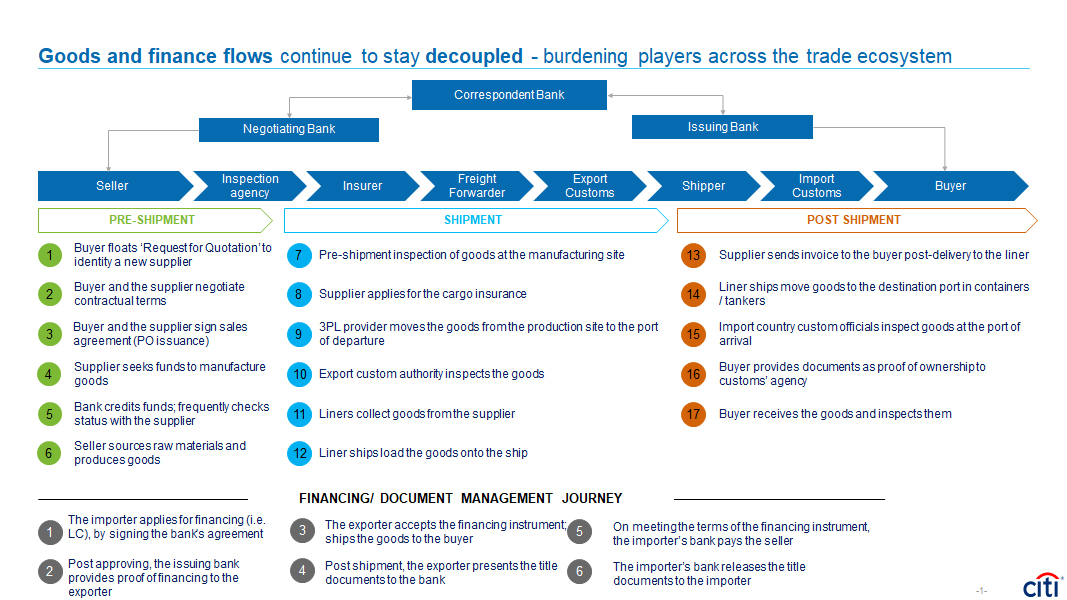

However, aligning financing with the flow of goods and funds remains a complex process costing many importers and exporters the efficiency gains made thanks to enhanced transport logistics. The current disconnect between the physical and financial supply chains is a primary reason for the estimated US$1.5 trillion worldwide trade finance gap (according to Asian Development Bank/ICC figures1). This renders many small and medium-sized enterprises (SMEs) – particularly those in emerging markets – incapable of accessing the funding required to support their trading activities.

According to the World Economic Forum, inadequate trade finance provision is among the top three export obstacles for half the world’s countries – making progress in this area vital not only for encouraging growth in trade but also for economic development and inclusivity.

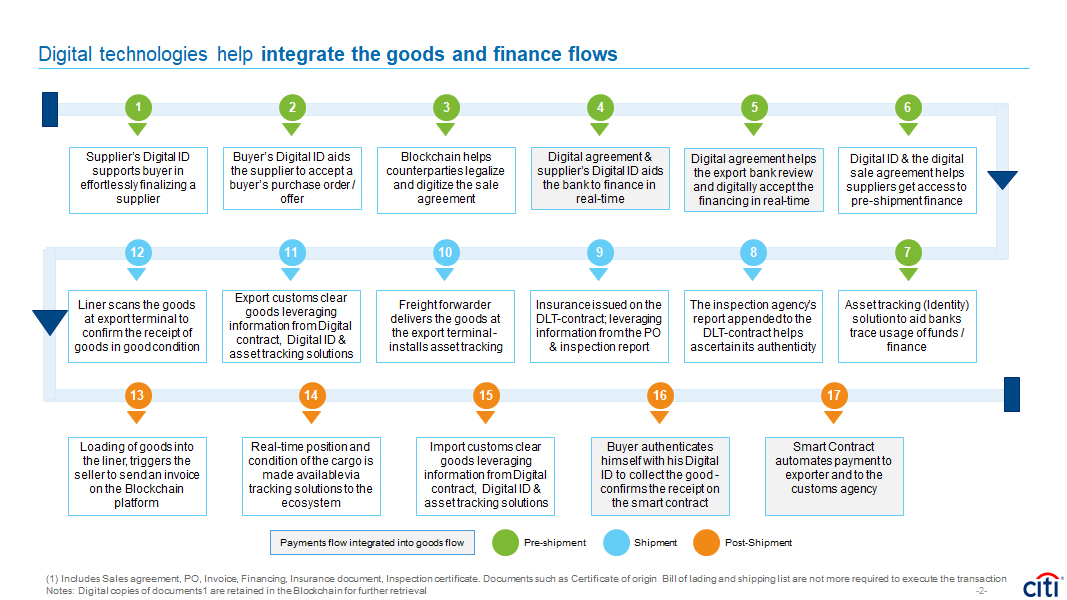

A key priority is to incorporate financial services into the “embedded trade” ecosystem. This will link more parties within the value chain and enhance the whole trade process. It embeds the logistics component of moving goods from one point to the other with the flow of funds, incorporates alternative data points in the underwriting of financial products to fill in unmet needs and addresses any funding gaps by identifying opportunities for corporates to access financing from embedded providers such as banks.

Increasing transparency

Given its presence in many stages throughout the supply chain, embedding financial services seamlessly into the overall shipment process can yield benefits for all. For instance, funds must be exchanged at various points, with the common funding gaps that emerge at these points needing bridging in order for the flow of goods to continue and the necessary changes in ownership to take place. Digitising paper documents, like a bill of lading, will provide a more efficient and automated way of executing ownership transfer. By being integrated in the logistics system, borrowers have direct access to financiers, meaning funding can be secured seamlessly.

The benefits for businesses extend far beyond capital allocation. In order to be eligible for funding, corporates must undergo in-depth checks to ensure a strong payment track-record and compliance with regulation. Through the use of smart contracts, internet of things (IoT), artificial intelligence (AI) and machine learning, these checks can be automated, thus mitigating the risks associated with non-compliance or movement.

For instance, IoT sensors can be used to determine the quality and presence of goods, and the storage and handling conditions, even whether components have been transported through sanctioned locations.

By processing and automating this information, not only are financiers able to make quicker, more informed, decisions on whether or not to finance importers and exporters, they are providing their clients with peace-of-mind regarding the counterparties they work with.

Financiers, shippers and shipment companies also benefit from clearer visibility into the shipment process and the availability of this data as it can provide them with a far more efficient way to manage the movement of consignments – reducing the need for additional counterparties within the supply chain, such as those that will undertake in-person checks on goods.

By applying machine learning models and analysing transaction data and assessing corporates’ needs, these platforms can offer recommendations on how services – such as the financing of imports – can be more efficiently provided. They can also optimise relationships throughout the supply chain by rendering the entire process more transparent – potentially improving terms and certainly reducing risk.

Reduced costs, reduced risk

Naturally, by creating a bundled service that gives all parties within the supply chain access to the goods and services they need, the overall cost of door-to-door shipments is lowered. For instance, an exporter will have access to financing earlier on in the transaction, ensuring receivables are collected sooner – in turn, reducing days sales outstanding (DSO). Corporates can also benefit from bundled financing options that combine both the shipping costs and the costs of goods, streamlining the financing process.

The digitisation of data, combined with the integration of parties within the embedded trade platform, can also directly minimise risks by cutting out unnecessary third parties.

A bill of lading, for instance, can sometimes be obtained by a third party (i.e. not directly from the issuing shipping company), resulting in forgery or inauthenticity risk. By instead obtaining this document digitally and directly from the shipping company – which is plugged in to the platform and the network – it can be trusted, mitigating the need for additional checks. This is the case with all documents in the transaction – from purchase orders to invoices – meaning that digitising the process can increase efficiency.

Challenges

Given that many entities in the trade supply chain are not yet up to speed digitally, ensuring the availability of the documents and information required to digitise these processes will likely incur onboarding costs. And while the longer-term benefits may mitigate this, ensuring that each jurisdiction of operation supports these documents in digital format is complex.

As such, the standardisation of business models and mediums of information exchange will be vital to the adoption of embedded trade platforms. In tandem, regulatory policies or guidelines surrounding international trade will also need to be standardised. In time, as the technology becomes more widespread, achieving critical mass will ensure richer data and more opportunities for all those integrated into the system.

On the horizon

As digitisation gains momentum the development and uptake of embedded trade continues.

A global trade ecosystem in which the management of physical supply chain activities and the purchasing of financial products are merged into a single, automated, process (that emphasises ease-of-use and a seamless user experience) presents a huge opportunity for companies to improve the efficiency of their trade operations.

The shift towards such embedded trade platforms promises lower operating costs while making capital more easily available – in turn, mitigating risk and streamlining the industry.

Citi is at the forefront of research in this space, and is already looking at key concepts, companies, platforms and fintech players in order to explore the ways in which the bank can offer clients a way of capitalising on emerging trends and the latest technologies.

Citi aims to make embedded trade a reality for its clients, acting as a key partner for businesses as they progress towards a more digital future.

1 https://www.adb.org/publications/2019-trade-finance-gaps-jobs-survey