Ecosystems: The emergence of value

Accelerating digital sales channels

As we live through this unchartered territory across the world, the consumer and retail industry has shown incredible flexibility and agility in times of disruption. In many ways, this industry is at the core of sustaining our everyday lives and maximising access to necessities across diverse geographies, buying behaviour and demographics. The resilience and leadership show the true value of the digital sales ecosystem and a few key learnings for future growth.

Saurabh R Gupta,

Asia Pacific Consumer

and

Healthcare Sales

Sector Head,

Treasury and Trade Solutions, Citi

Winning the Race for Digital Sales in the New Normal

‘Citi’s Global Insights reported an almost 9 times jump in online retailing, 5 times jump in e-commerce volumes and 6 times jump in food delivery.’

Traditionally, the consumer and retail industries work on highly integrated ecosystems namely producers and their supply chains, distributors and their logistics and finally last mile connectivity led by modern retail or grocery/convenience stores. Over the last decade, this paradigm has been evolving rapidly towards digital and data-led landscape for the industry. This evolution was already driving major changes in business models to develop a much more flexible ecosystem and embracing new players. Producers and their supply chains started to leverage data to understand consumer behavior, with a surge of platforms that offered alternate distribution models and finally brick and mortar outlets transformed into an omni-channel window.

As a reference point, we entered 2020 with *estimates that at the end of 2019 online sales were slightly more than 14% and the journey to a critical mass of 25% was still a couple of years away. The COVID-19 pandemic caught all of us by surprise and beyond health and safety, it significantly affected daily lives with immediate lockdown and social distancing.

Many businesses raced to make the most of existing digital platforms and many others quickly developed a digital front-end sales model and manual backend process to keep things running. @ Citi’s Global Insights reported an almost 9 times jump in online retailing, 5 times jump in e-commerce volumes and 6 times jump in food delivery. The focus was to simply keep their respective ships afloat through these unprecedented times. Also this adoption of digital sales channels has shifted consumer behavior and gave a reflection of the future of the industry.

Digital alternate sales channels led by consumer buying behavior are largely three main categories: online marketplaces (global or regional or local), digital direct model or brand.com and lastly using a subscription-based model. As COVID-19 passes by, each of them will have some degree of participation with a bricks-and-mortar stores model and that will co-exist for the future. In tandem, consumer expectations have been transformed as a result, demanding quick, convenient and secure payment, followed by a rapid delivery of goods.

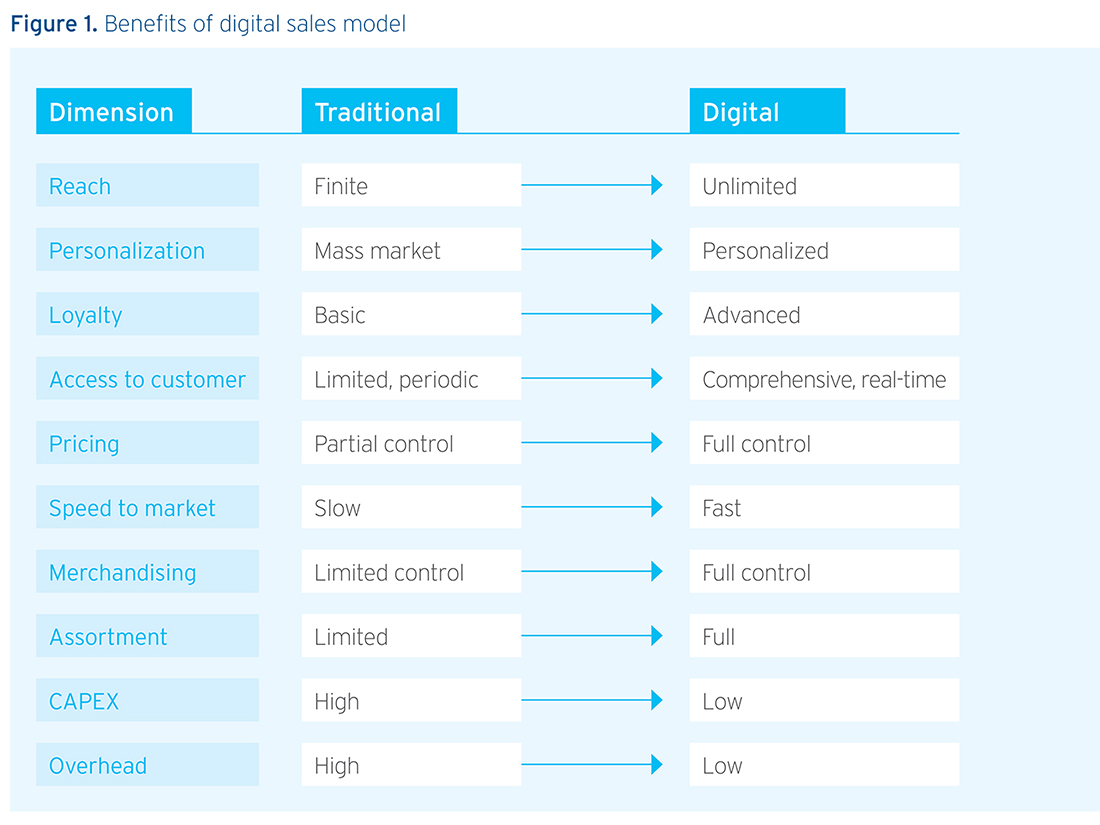

Bringing together the physical and digital has enormous implications for a company’s ability to reach new markets and customer segments in highly personalized ways, with 24/7 direct customer access, control over pricing and product availability, on top of rapid speed to market. At the same time, costs are lower, and cash flows more reliable and predictable.

Interestingly these digital sales channels do bring new challenges to treasury, finance and business leaders. Treasurers and finance managers have different banking needs to support direct-to-consumer (D2C) models than previous – or, more likely, parallel – business-to-business (B2B) models. In our recent survey done during a Citi webinar, 8 May 2020 - ‘Winning the race for digital sales in the new normal’, corporates shared that over 47% face issues of availability of collection channels as well as reconciliation. This includes high cost of fees linked to collection as well as accessibility of data.

Companies going D2C or business-tobusiness (B2B) in Asia face the problem of dealing with cash, especially in the segments of premium consumer staples, beverage, fashion and luxury goods. If you look at markets like Singapore or Hong Kong, credit card usage is common, leading to extra cost in associated fees.

Citi has been investing into future technologies leveraging instant payment rails across Asia and a multitude of fintech partnerships to ensure that clients have access to best-in-class collections options, data analytics, reconciliation tools whilst facilitating a seamless user experience for purchase, refunds and customer service. We are live in 11 markets with instant payments capability to facilitate instant, costefficient and secure payments. We offer these services through industry-standard QR option for tokenization for instant reconciliation. Adoption during the current crisis has been phenomenal and has helped clients get started for their digital journey within a couple of hours. Companies who want to accelerate their online strategy will be evaluating best practices and players in the local markets of choice which will influence time to market and cost of delivery. It will be important to choose select providers who offer a standardized user experience across as many markets as possible to expedite availability.

‘Within the B2C space, retail companies especially beauty, hospitality and lifestyle providers are moving fast towards offering subscription services models.’

The ability to provide seamless, appbased payments is an essential success factor for digital sales platforms. This also supports dynamic integration and real-time data movement riding on Citi’s API catalogue. These APIs, besides providing real-time credit notification, also help in refunds and customer information services for enhanced user experience.

Within the B2C space, retail companies especially beauty, hospitality and lifestyle providers are also moving fast towards offering subscription services models. These models need the ability to take regular payments seamlessly, such as instant direct debits (live in Hong Kong) or Request to Pay (live in India), to minimize churn and enhance customer convenience. They also need to reconcile incoming flows quickly and easily to avoid interruption in the clients’ enjoyment of their products and services, so payer ID and automatic reconciliation solutions are becoming increasingly important.

Simultaneously, we have companies looking to collaborate with leading marketplaces (global/regional/local) to list their products online. Retail companies selling consumer staples and daily utilities prefer this model. In addition, other retail companies leverage marketplaces in combination with other digital sales platforms for diversification. From a retail standpoint, this is a faster model to get started on a digital channel, offers an embedded collection mechanism and logistics for the last mile. For retail companies, this in many ways is like the B2B channel of a physical distributor model; however, the marketplace is now selling digital solutions to end consumers.

Obviously, this provides a slightly different nature of treasury and finance work slate. Marketplaces especially in North Asia, like China, tend to carry out transactions through mobile wallets from the sales. However, corporates are looking for sales proceeds to be moved to their bank account. In China, Citi works with several local partners to move wallet collection to the bank account directly. Additionally, these sales provide an opportunity for orderto- cash application and Citi’s clients have successfully deployed payer ID solutions for Stock Keeping Unit (SKU) level reconciliation and application. Payer ID services are available across all Asian countries and Citi® Smart Match leverages Artificial Intelligence / Machine Learning to facilitate invoice level reconciliation across all payment channels and methods. At Citi, we endeavor to develop customized solutions for your specific journey that would meet the needs to support your business transformation.

We will soon launch “Spring by Citi” globally and thereafter to be expanded into Asia. This full-stack solution enables institutions to accept digital payments from consumers. This platform provides access to payment gateway technology, locally relevant payment methods, funds settlement, reconciliation and reporting - all-in-one.

If corporates want to leverage online acceleration to broaden the distribution of products into new markets where they do not have a presence, Citi is able to facilitate the cross-border receipts/remittances through low cost alternatives.

The value of engaging digitally can be substantial (figure 1) with lower costs, more supply chain flexibility and the ability to customize products more directly to customer preferences, which ultimately benefits the company, its customers and its supply chain partners.

Citi runs a full service consumer bank in 12 markets across Asia and that offers an important banking partner for focused campaigns or other partnership opportunities to expand in this digital sales ecosystem.

Companies moving into digital sales models are not only looking for new banking solutions, but an entirely new dialogue, taking a 360-degree view of their whole business. By identifying the participants in their ecosystem, and removing friction from each interaction, companies can leverage strengths from across the ecosystem to serve their customers’ needs more effectively and cost-efficiently, obtain and learn from better data, and build more sustainable, robust enterprises.

‘Payer ID services are available across all Asian countries and Citi® Smart Match leverages Artificial Intelligence / Machine Learning to facilitate invoice level reconciliation across all payment channels and methods.’

* eMarketer, May 2019

@Citi Global Insights, June 2020 – COVID-19 Country Recovery Watch | Through the lens of alternative data