8

I

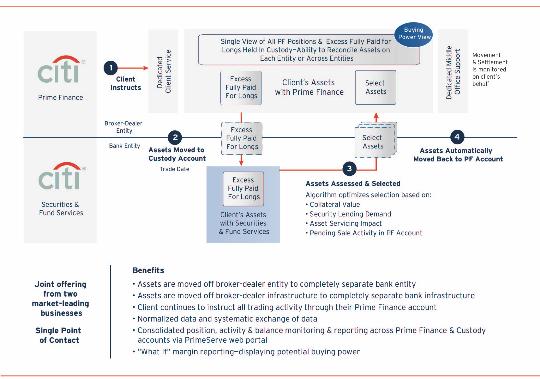

Prime Custody: Achieving Asset Protection & Operational Simplicity

Chart 5: Citi’s Prime Custody Offering

Citi’s Prime Custody offering also exceeds the geographic

reach of any competitor in this space, providing a truly global

solution that delivers to hedge funds and investment managers

the information they need in the local market time required

to realize their investment strategy. Citi Prime Finance

operates in more markets worldwide than any competitor.

This reach is matched and enhanced by Citi Securities and

Fund Services with the industry’s largest and most established

custodial network.

The fnal aspect of Citi’s offering is the provision of a smart

algorithm. This algorithm was designed to optimize the

Citi Prime Custody service from both a risk and fnancing

perspective to help our clients obtain the leverage they require

at an effcient price point.

Our smart asset selection algorithms take into account the

outstanding margin requirement on the Prime Finance account

and then fgure out what excess exists across both the Prime

Finance and Custody asset pools.

In addition to assessing the fnancing potential of assets, our

Prime Custody offering recognizes that an asset servicing

event is forthcoming and automatically sweeps back that asset

from the custody account so that the hedge fund or investment

manager can take full advantage of the Prime Broker’s longer

declaration window.